What is Spot?

Spot is a decentralized, inflation resistant store of value that fills the gap between speculative cryptocurrencies and dollar substitutes. It builds on top of the Ampleforth and Buttonwood protocols and it is governed by FORTH.Spot was created by the Ampleforth team, whose goal is to create a safer and more resilient financial ecosystem that does not rely on centralized custodians, or lenders of last resort.

What is Spot?

Spot is a decentralized, inflation resistant store of value that fills the gap between speculative cryptocurrencies and dollar substitutes. It builds on top of the Ampleforth and Buttonwood protocols and it is governed by FORTH.Spot was created by the Ampleforth team, whose goal is to create a safer and more resilient financial ecosystem that does not rely on centralized custodians, or lenders of last resort.

What Differentiates Spot from other stable assets?

- SPOT can wind down to 0 users and reboot. Since SPOT is simply a proportional claim on a set of assets, it can never be undercollateralized.

- SPOT has no explicit feedback loops and does not react to the market.

- No reliance on bailouts or lenders of last resort. Independent monies do not have the luxury of a backing state who can step in. This also means there are no liquidations, which rely on outside bailout capital and can result in liquidation cascades.

- No reliance on continual growth. SPOT can grow and shrink with demand in the market without saddling itself with future obligations.

- SPOT holds collateral, but is not subject to bank runs.

- Risk is transparent so it can be properly priced. Tranching and bundling are well understood in finance and all of this is viewable onchain.

What is Spot?

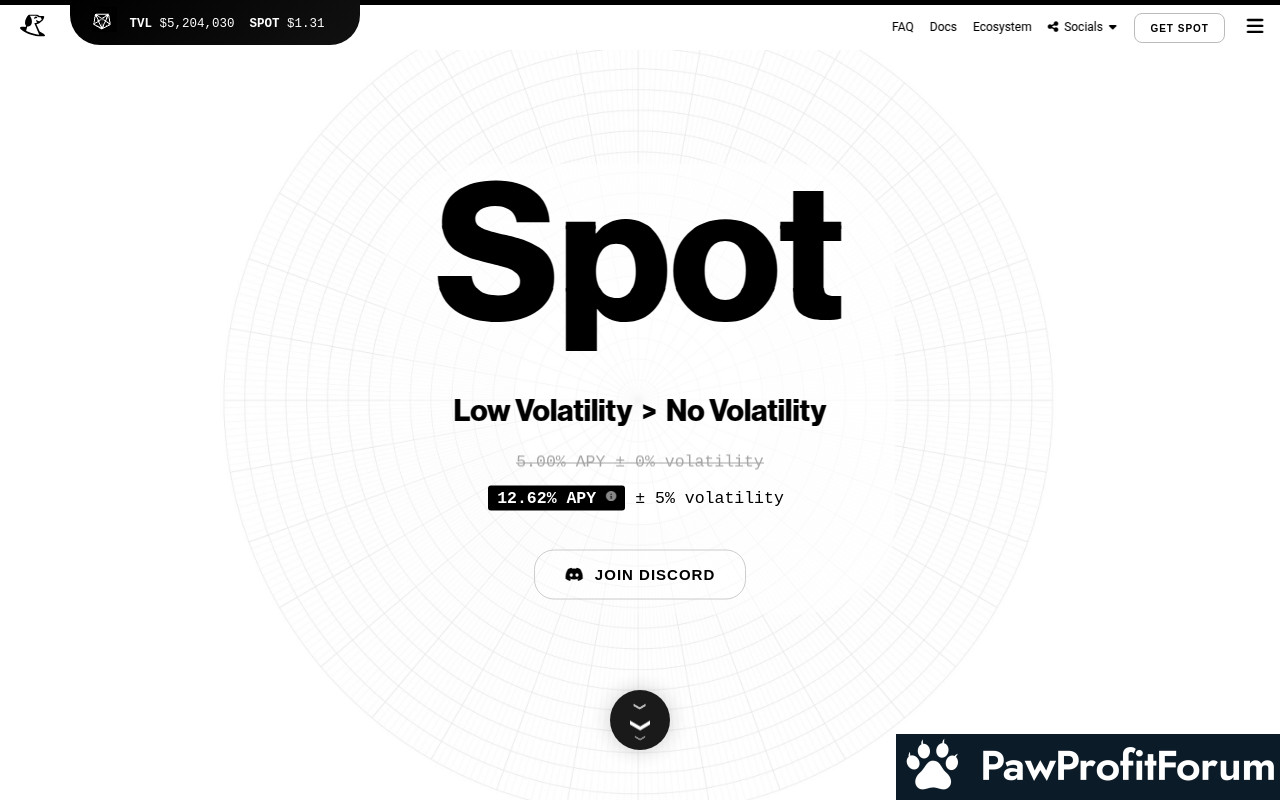

Spot (SPOT) emerges as a unique player in the cryptocurrency landscape, designed to offer a low-volatility, inflation-resistant store of value. Unlike many digital assets, SPOT reorganizes the volatility of its underlying collateral asset, Ampleforth (AMPL), into two derivative assets: SPOT and stAMPL. This innovative structure allows SPOT to act as a redeemable claim on a basket of on-chain collateral, providing a more stable refuge from inflation.The creation of SPOT is rooted in the Ampleforth and Buttonwood protocols, aiming to build a safer and more resilient financial ecosystem without relying on centralized custodians or lenders of last resort. This decentralized approach ensures that SPOT can wind down to zero users and reboot, maintaining its proportional claim on a set of assets without ever becoming undercollateralized.

SPOT's design eliminates explicit feedback loops and market reactions, distinguishing it from other stable assets. It operates independently of bailouts or external capital, avoiding the pitfalls of liquidation cascades and the need for continual growth. This independence means SPOT can grow and shrink with market demand without future obligations, holding collateral without the risk of bank runs.

Transparency is a cornerstone of SPOT's risk management. The tranching and bundling of assets are well understood in finance and fully viewable on-chain, allowing for proper risk pricing. This transparency, combined with its decentralized nature, positions SPOT as a robust alternative to traditional stablecoins and speculative cryptocurrencies.

What is the technology behind Spot?

Spot (SPOT) operates on a decentralized blockchain that leverages the Ampleforth and Buttonwood protocols. This blockchain is designed to be a redeemable claim on a basket of on-chain collateral, ensuring that SPOT remains a stable and inflation-resistant store of value. Unlike traditional financial systems that rely on centralized custodians or lenders of last resort, Spot's architecture is built to be resilient and independent.One of the key features of Spot's blockchain is its ability to prevent attacks from bad actors. This is achieved through a combination of cryptographic techniques and decentralized consensus mechanisms. The blockchain uses a proof-of-stake (PoS) system, where validators are chosen based on the number of tokens they hold and are willing to "stake" as collateral. This makes it economically unfeasible for bad actors to launch attacks, as they would need to control a significant portion of the tokens, which would be prohibitively expensive.

In addition to its robust security measures, Spot incorporates satellite safety devices, cloud automation, AI camera systems, and logistics software for tracking and security purposes. These technologies work together to enhance the overall security and efficiency of the network. For example, satellite safety devices can provide real-time monitoring and alerts, while AI camera systems can detect and respond to suspicious activities.

Spot's blockchain also has unique characteristics that set it apart from other stable assets. It can wind down to zero users and reboot without becoming undercollateralized, as it is simply a proportional claim on a set of assets. This means that even if the number of users drops to zero, the value of SPOT remains intact. Furthermore, SPOT does not rely on explicit feedback loops or market reactions, making it more stable and less susceptible to market volatility.

Another important aspect of Spot's technology is its transparency and risk management. All collateral and transactions are viewable on-chain, allowing users to verify the integrity of the system. This transparency ensures that risks are properly priced and managed, reducing the likelihood of financial crises such as bank runs or liquidation cascades.

Spot's governance is managed by FORTH, which ensures that the system remains decentralized and community-driven. This governance model allows for continuous improvement and adaptation to changing market conditions, without relying on centralized authorities or external bailouts.

The integration of advanced technologies such as cloud automation and logistics software further enhances Spot's operational efficiency. Cloud automation streamlines processes and reduces the need for manual intervention, while logistics software ensures accurate tracking and management of assets. These technologies work in tandem to create a seamless and secure ecosystem for SPOT users.

Spot's ability to grow and shrink with market demand without incurring future obligations makes it a flexible and sustainable financial instrument. Unlike traditional financial systems that require continual growth to remain solvent, SPOT can adapt to changing market conditions without compromising its stability or security.

The combination of decentralized governance, advanced security measures, and innovative technologies makes Spot a robust and reliable store of value. Its unique design ensures that it remains resilient in the face of market fluctuations and external threats, providing users with a secure and stable financial asset.

What are the real-world applications of Spot?

Spot (SPOT) is a decentralized cryptocurrency designed to serve as a low-volatility commodity money that is durable, decentralized, and resistant to inflation. It aims to bridge the gap between speculative cryptocurrencies and traditional dollar substitutes. Built on the Ampleforth and Buttonwood protocols, Spot is governed by FORTH and offers several unique features that differentiate it from other stable assets.One of the primary real-world applications of Spot is its use as a safe asset. Unlike traditional financial systems that rely on centralized custodians or lenders of last resort, Spot operates independently, ensuring that it can never be undercollateralized. This makes it a reliable store of value, especially in times of economic uncertainty. Additionally, Spot's design allows it to wind down to zero users and reboot, providing a level of resilience not commonly found in other cryptocurrencies.

In the financial sector, Spot can be utilized for spot trading, offering a stable and decentralized alternative to traditional trading assets. Its inflation-resistant nature makes it an attractive option for investors looking to hedge against currency devaluation. Furthermore, Spot's transparent risk profile allows for proper pricing and understanding of financial tranching and bundling, all of which are viewable on-chain.

Spot also finds applications in the realm of smart contracts. Its decentralized nature ensures that contracts executed on its platform are secure and free from the risks associated with centralized control. This makes it a valuable tool for industries such as supply chain management, where tracking assets and ensuring the integrity of transactions are crucial.

In the healthcare sector, Spot's capabilities can be customized to track medical supplies and ensure the authenticity of pharmaceuticals. This helps in combating counterfeit drugs and maintaining the integrity of the supply chain.

Spot's versatility extends to media and virtual exchanges as well. For instance, it can be used in virtual cat exchanges, providing a stable and secure medium for transactions in digital collectibles and other virtual assets.

Overall, Spot's unique features and decentralized nature make it a valuable tool across various industries, offering stability, transparency, and security in financial transactions and asset management.

What key events have there been for Spot?

Spot (SPOT) is a decentralized, inflation-resistant store of value designed to bridge the gap between speculative cryptocurrencies and dollar substitutes. Developed by the Ampleforth team, Spot aims to create a safer and more resilient financial ecosystem without relying on centralized custodians or lenders of last resort.One of the most significant events for Spot is its participation in the Blockchain Life 2024 conference in Dubai. This event is a major gathering in the blockchain and cryptocurrency space, providing Spot with a platform to showcase its unique attributes and engage with a global audience of industry leaders, developers, and investors.

Spot differentiates itself from other stable assets through several key features. It can wind down to zero users and reboot, ensuring it can never be undercollateralized. Unlike other assets, Spot has no explicit feedback loops and does not react to market conditions. This independence from market fluctuations means it does not rely on bailouts or lenders of last resort, avoiding the pitfalls of liquidation cascades.

Additionally, Spot does not depend on continual growth. It can expand and contract with market demand without incurring future obligations. The collateral held by Spot is not subject to bank runs, providing a stable and transparent risk profile that can be properly priced. The financial mechanisms of tranching and bundling are well understood and viewable on-chain, enhancing transparency and trust.

As of the time of writing, there have been no other key events for Spot.

Who are the founders of Spot?

Spot (SPOT) emerges as a decentralized, inflation-resistant store of value, bridging the gap between speculative cryptocurrencies and dollar substitutes. It leverages the Ampleforth and Buttonwood protocols and is governed by FORTH. Despite its innovative approach, the founders of Spot remain undisclosed. The Ampleforth team, known for their efforts to create a resilient financial ecosystem free from centralized custodians, is credited with its creation. The lack of explicit feedback loops and reliance on bailouts further distinguishes SPOT from other stable assets, ensuring transparency and resilience in its financial operations.| Website | www.spot.cash |

| Website | drive.google.com/file/d/1MTp3vGLBtCp4Pte7ohHfnRfeKgFPaWQd/view?usp=share_link |

| Socials | twitter.com/spotprotocol |

| Socials | github.com/ampleforth/spot |

| Socials | discord.gg/mptQ49m |

| Contracts | 0xC1f3...81bafE |

| Explorers | etherscan.io/token/0xC1f33e0cf7e40a67375007104B929E49a581bafE |