INTRO

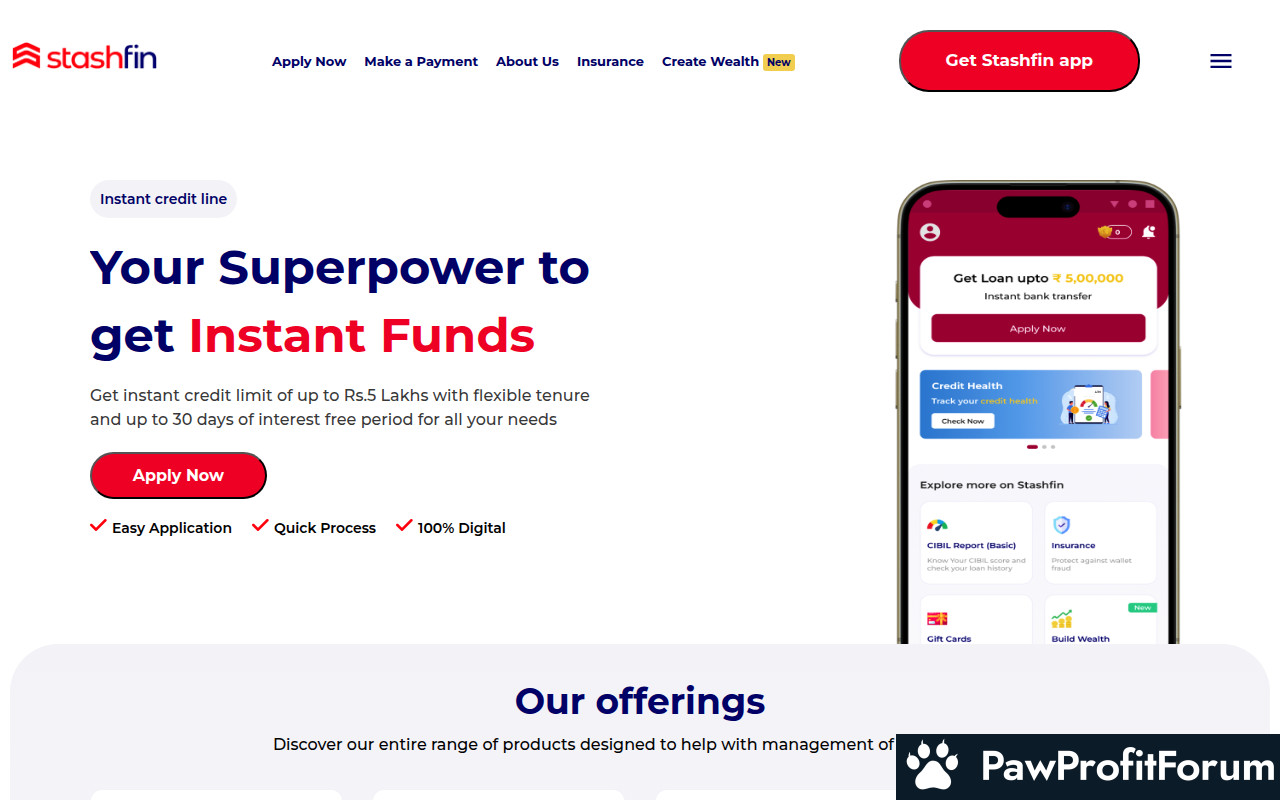

StashFin is a digital lending platform that provides personal loans to salaried individuals and self-employed professionals. Operating primarily in India, the platform aims to offer quick and convenient access to credit for various financial needs. StashFin utilizes technology and data analytics to streamline the loan application and approval process, making it easier for users to obtain funds. The company focuses on providing flexible loan options and repayment plans tailored to individual circumstances.

All You Need to Know and How it Works

StashFin offers personal loans ranging from ₹1,000 to ₹5,00,000 with repayment tenures from 3 to 36 months. The application process is entirely online through the StashFin app or website. Users need to provide personal and financial information, including KYC documents and bank statements. Once the application is submitted, StashFin assesses the creditworthiness of the applicant and approves the loan if all criteria are met. The approved loan amount is then disbursed directly into the applicant's bank account.

What Makes StashFin Stand Out?

How to Maximize Your Experience on StashFin

Why Trust StashFin?

StashFin is a registered Non-Banking Financial Company (NBFC) regulated by the Reserve Bank of India (RBI). The platform employs secure data encryption and follows industry best practices to protect user information. They have established partnerships with leading financial institutions and maintain transparency in their lending practices. However, users should still exercise caution and carefully evaluate their ability to repay the loan before borrowing.

FAQs

SUMMARY

StashFin is a digital lending platform offering quick personal loans with flexible repayment options. While it provides convenience and accessibility, users must carefully assess their financial situation and repayment capacity before taking a loan.

Given these insights, thorough research and caution are advised before engaging with StashFin.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

StashFin is a digital lending platform that provides personal loans to salaried individuals and self-employed professionals. Operating primarily in India, the platform aims to offer quick and convenient access to credit for various financial needs. StashFin utilizes technology and data analytics to streamline the loan application and approval process, making it easier for users to obtain funds. The company focuses on providing flexible loan options and repayment plans tailored to individual circumstances.

All You Need to Know and How it Works

StashFin offers personal loans ranging from ₹1,000 to ₹5,00,000 with repayment tenures from 3 to 36 months. The application process is entirely online through the StashFin app or website. Users need to provide personal and financial information, including KYC documents and bank statements. Once the application is submitted, StashFin assesses the creditworthiness of the applicant and approves the loan if all criteria are met. The approved loan amount is then disbursed directly into the applicant's bank account.

What Makes StashFin Stand Out?

- Quick and convenient online application process

- Flexible loan amounts and repayment tenures

- Minimal documentation requirements

- Instant approval and disbursal

- User-friendly mobile app

How to Maximize Your Experience on StashFin

- Ensure accurate and complete information during application.

- Understand the terms and conditions before accepting the loan.

- Set up timely reminders for EMI payments.

- Utilize the customer support channels for any queries or assistance.

- Monitor your credit score regularly to ensure financial health.

Why Trust StashFin?

StashFin is a registered Non-Banking Financial Company (NBFC) regulated by the Reserve Bank of India (RBI). The platform employs secure data encryption and follows industry best practices to protect user information. They have established partnerships with leading financial institutions and maintain transparency in their lending practices. However, users should still exercise caution and carefully evaluate their ability to repay the loan before borrowing.

FAQs

- What is the minimum loan amount offered by StashFin?

Answer: The minimum loan amount is ₹1,000. - What is the maximum repayment tenure for StashFin loans?

Answer: The maximum repayment tenure is 36 months. - Is StashFin available in all cities in India?

Answer: StashFin is available in select cities across India. Check their website or app for the updated list.

SUMMARY

StashFin is a digital lending platform offering quick personal loans with flexible repayment options. While it provides convenience and accessibility, users must carefully assess their financial situation and repayment capacity before taking a loan.

Given these insights, thorough research and caution are advised before engaging with StashFin.

Questions to Guide Your Review

- What has been your experience with StashFin's services?

- Have you encountered any issues with the loan application or disbursal process?

- How does StashFin compare to other similar lending platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback