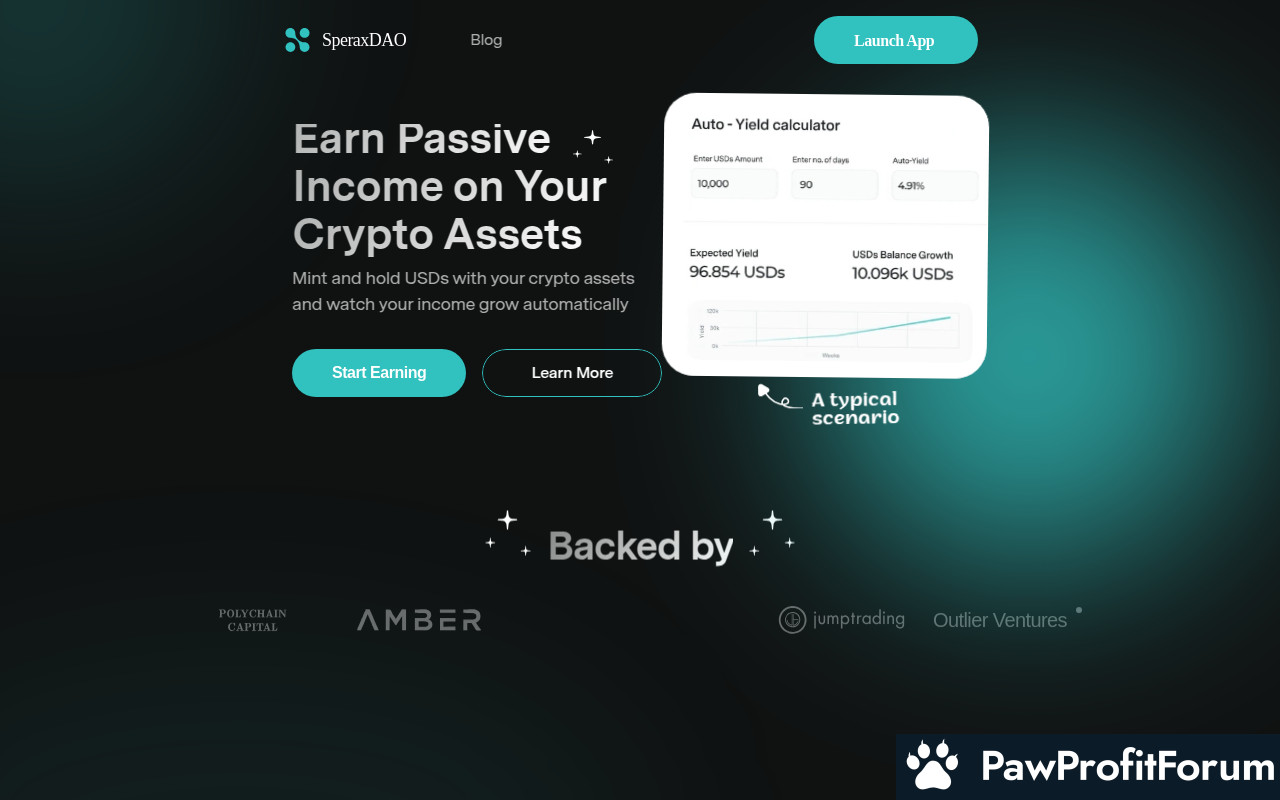

Auto-yield.

Users holding USDs in their wallets automatically earn organic yield. Neither staking not claiming required by the end user. Users do not need to spend gas and their time calling the smart contract to claim their yield - the yield is distributed directly to the wallets of USDs holders.Auto-yield.

Users holding USDs in their wallets automatically earn organic yield. Neither staking not claiming required by the end user. Users do not need to spend gas and their time calling the smart contract to claim their yield - the yield is distributed directly to the wallets of USDs holders.Layer2-native

Cheaper transaction fees on Arbitrum make this protocol retail investor-friendlyFully Backed Model

USDs is 100% backed by a diversified basket of whitelisted stablecoins.What is Sperax USD?

Sperax USD (USDs) stands out in the cryptocurrency landscape as a fully collateralized stablecoin that not only maintains its value but also generates organic yield for its holders. Unlike traditional stablecoins, USDs offers a unique auto-yield feature, allowing users to earn yield directly in their wallets without the need for staking or manually claiming rewards. This yield distribution is gas-free, enhancing user convenience and efficiency.Operating on the Arbitrum network, the largest Layer-2 ecosystem of Ethereum, USDs benefits from significantly lower transaction fees, making it accessible and cost-effective for retail investors. The stablecoin's fully backed model ensures that it is 100% collateralized by a diversified basket of whitelisted stablecoins, providing a robust foundation for its value stability.

Governance plays a crucial role in the management of USDs, with decisions made through a decentralized process that involves the community. This governance model ensures transparency and aligns the interests of all stakeholders. USDs can be traded on prominent exchanges such as Uniswap v3 (Arbitrum) and Camelot, offering liquidity and ease of access for users.

Looking ahead, Sperax aims to enhance interoperability, enabling USDs to be natively deployed across all major blockchain platforms. This vision underscores the potential for USDs to become a versatile and widely adopted stablecoin in the evolving digital economy.

What is the technology behind Sperax USD?

The technology behind Sperax USD (USDs) is a fascinating blend of blockchain innovation and financial engineering. At its core, Sperax USD is a stablecoin that generates auto-yield natively on the Arbitrum network, which is a Layer-2 solution for Ethereum. This means that users holding USDs in their wallets automatically earn yield without needing to stake or claim rewards manually. The yield is distributed directly to the wallets of USDs holders, making it a seamless experience.Arbitrum, the blockchain on which USDs operates, is designed to enhance scalability and reduce transaction fees compared to the Ethereum mainnet. By leveraging Arbitrum, Sperax USD benefits from faster transaction speeds and lower costs, making it more accessible to a broader range of users. The Layer-2 nature of Arbitrum also helps in preventing attacks from bad actors by utilizing Ethereum's robust security while offloading the computational burden to a secondary layer.

The security of the Sperax USD protocol is further bolstered by its fully backed model. USDs is 100% backed by a diversified basket of whitelisted stablecoins, ensuring that each USDs token is supported by real assets. This collateralization provides a safety net, maintaining the stability and trustworthiness of the stablecoin. Additionally, the protocol employs a combination of collateralized stablecoins and algorithmic mechanisms to maintain its peg to the US dollar.

Another critical component of the Sperax ecosystem is the Sperax token (SPA). SPA plays a vital role in the governance and operation of the Sperax protocol. Token holders can participate in decision-making processes, such as protocol upgrades and changes to the collateral basket, ensuring a decentralized and community-driven approach.

Sperax USD's interoperability vision aims to deploy USDs natively across all major blockchain platforms. This would allow users to benefit from the auto-yield feature and stablecoin stability regardless of the blockchain they prefer. The goal is to create a seamless and interconnected ecosystem where USDs can be utilized across various decentralized applications (dApps) and platforms.

The auto-yield feature of USDs is particularly noteworthy. Unlike traditional yield farming or staking, where users must actively participate and often pay gas fees to claim their rewards, USDs holders earn yield passively. This is achieved through smart contracts that automatically distribute the yield to all holders, eliminating the need for manual intervention and reducing the complexity for users.

In terms of transaction efficiency, the use of Arbitrum's Layer-2 technology significantly reduces the cost and time associated with transactions. This makes USDs an attractive option for retail investors who might be deterred by the high fees and slow speeds of the Ethereum mainnet. The lower transaction fees also encourage more frequent use and adoption of USDs in everyday transactions and decentralized finance (DeFi) activities.

The combination of these technological elements—auto-yield generation, Layer-2 scalability, a fully backed model, and interoperability—creates a robust and user-friendly stablecoin. The integration of SPA for governance and the use of advanced blockchain technology ensure that Sperax USD remains secure, efficient, and adaptable to the evolving landscape of decentralized finance.

What are the real-world applications of Sperax USD?

Sperax USD (USDs) stands out in the cryptocurrency landscape as a stablecoin designed to generate auto-yield natively. This means that users holding USDs in their wallets automatically earn yield without needing to stake or claim rewards manually. This feature simplifies the process of earning passive income, making it accessible to a broader audience, including those who may not be tech-savvy.One of the primary real-world applications of USDs is in the realm of decentralized finance (DeFi). Users can engage in stablecoin yield farming, a process where they provide liquidity to DeFi platforms and earn rewards. This is particularly advantageous for those looking to maximize their returns without dealing with the high volatility typically associated with cryptocurrencies.

Trading on cryptocurrency exchanges is another significant application. USDs can be traded on platforms such as Uniswap v3 and Camelot, providing liquidity and facilitating transactions within the DeFi ecosystem. This trading capability ensures that users can easily buy, sell, or exchange USDs, enhancing its utility and adoption.

USDs also offers unique features like gasless transfers, which means users do not need to pay transaction fees when transferring USDs between wallets. This feature is particularly beneficial for small transactions, making it more cost-effective and user-friendly.

Additionally, USDs is live on Arbitrum, the largest Layer-2 ecosystem of Ethereum. This integration allows for cheaper transaction fees, making it more accessible to retail investors. The protocol's fully backed model ensures that USDs is 100% backed by a diversified basket of whitelisted stablecoins, providing stability and trust.

In the future, Sperax aims to build a system of interoperability, enabling USDs to be deployed across all major blockchain platforms. This would further expand its real-world applications, making it a versatile tool in both DeFi and traditional finance.

What key events have there been for Sperax USD?

Sperax USD (USDs) is a stablecoin designed to generate auto-yield natively, providing users with organic yield directly in their wallets without the need for staking or claiming. This innovative feature has positioned USDs as a significant player in the cryptocurrency landscape.One of the pivotal moments for Sperax USD was its launch on BitGo, a leading digital asset trust company and security platform. This event marked a crucial step in enhancing the security and trustworthiness of USDs, making it more appealing to institutional investors and large-scale traders.

Following its launch on BitGo, USDs made its debut on several prominent decentralized exchanges. Notably, it was listed on Uniswap, one of the largest decentralized exchanges on the Ethereum network. This listing provided USDs with substantial liquidity and accessibility, allowing users to trade the stablecoin seamlessly. Additionally, USDs was also listed on Camelot, further expanding its reach within the decentralized finance (DeFi) ecosystem.

In the realm of yield farming, Sperax USD has been actively utilized in stablecoin yield farming strategies. This involvement has allowed users to maximize their returns by leveraging the auto-yield feature of USDs, which distributes yield directly to the holders' wallets without requiring additional actions. This has made USDs an attractive option for yield farmers looking for efficient and low-maintenance investment opportunities.

Another significant milestone for Sperax USD was its launch on Arbitrum, the largest Layer-2 ecosystem of Ethereum. This integration brought several advantages, including cheaper transaction fees and faster transaction times, making USDs more accessible and user-friendly for retail investors. The Layer-2 native aspect of USDs on Arbitrum has been a key factor in its growing popularity and adoption.

Sperax USD has also been proactive in engaging with the cryptocurrency community through various initiatives, such as upcoming AMAs (Ask Me Anything) sessions. These events have provided a platform for the Sperax team to communicate directly with users, address their questions, and share insights about the future developments of USDs. This open line of communication has helped build a strong foundation of trust and transparency within the community.

Partnerships have played a crucial role in the growth and development of Sperax USD. By collaborating with other projects and platforms within the cryptocurrency space, Sperax has been able to enhance the functionality and utility of USDs. These partnerships have not only increased the visibility of USDs but have also contributed to its integration into various DeFi protocols and applications.

The fully backed model of USDs, which ensures that the stablecoin is 100% backed by a diversified basket of whitelisted stablecoins, has been another key aspect of its appeal. This model provides users with confidence in the stability and reliability of USDs, making it a preferred choice for those seeking a secure and stable digital asset.

At the time of writing, Sperax USD continues to build on its strong foundation, with plans to achieve interoperability across all major blockchain platforms. This vision aims to make USDs a universally accessible stablecoin, further solidifying its position in the global cryptocurrency market.

Who are the founders of Sperax USD?

Sperax USD (USDs) is a stablecoin designed to generate auto-yield natively, currently live on Arbitrum, Ethereum's largest Layer-2 ecosystem. The founders of Sperax USD include Frida Cai, Tiantian Kullander, and Damian Scavo. Frida Cai brings extensive experience in blockchain technology and finance, contributing to the strategic direction of Sperax USD. Tiantian Kullander, known for his expertise in financial markets and technology, plays a crucial role in the project's development. Damian Scavo, with a background in fintech and blockchain, adds significant value through his technical and operational insights.| Website | sperax.io/ |

| Website | docs.sperax.io |

| Socials | twitter.com/SperaxUSD |

| Socials | github.com/Sperax |

| Socials | discord.gg/cFdcvj9jMm |

| Contracts | 0xd74f...2d5748 |

| Audits | https://certificate.quantstamp.com/full/sperax-us-ds/0612feed-ab51-4cb5-a2b2-32ed244dc385/index.html |

| Explorers | arbiscan.io/token/0xd74f5255d557944cf7dd0e45ff521520002d5748 |