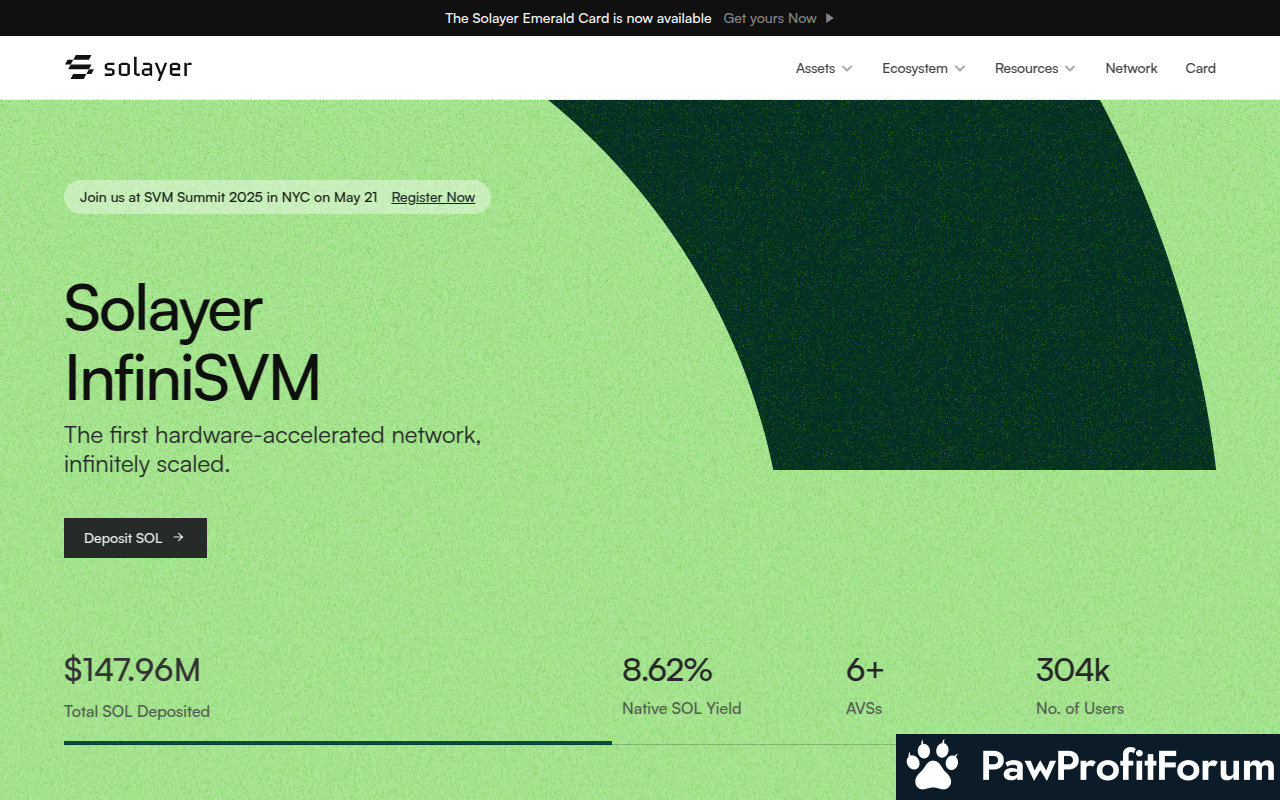

Solayer is a restaking protocol built natively on Solana. Solayer leverages Solana’s economic security and premium execution as the decentralized cloud infrastructure to enable a higher degree of consensus and blockspace customization for application developers.

This is done with 2 approaches: a) Restaking is the most economical way to secure future distributed systems. Think of it as importing a library to create an economically secure POS efficiently.

b) Solayer restaking has two value propositions: i. Securing exogenous AVSs, which are off-chain applications. ii. Providing stake-weighted Quality of Service (QoS) Infrastructure for on-chain dApps (Endogenous AVSs)

sSOL is a liquid token on Solayer that unlocks a range of DeFi use cases such as liquidity provisioning, collateral, and spot trading.

The protocol's dual value propositions are noteworthy. Firstly, it secures exogenous application-specific validators (AVSs), which are off-chain applications, ensuring their integrity and reliability. Secondly, it provides a stake-weighted Quality of Service (QoS) infrastructure for on-chain dApps, known as endogenous AVSs, thereby optimizing their performance and reliability.

sSOL, the liquid token of Solayer, unlocks a myriad of decentralized finance (DeFi) opportunities. It serves as a versatile asset for liquidity provisioning, collateral, and spot trading, enhancing the financial ecosystem within the Solana network. By integrating decentralized cloud infrastructure, Solayer SOL offers developers a platform for consensus and blockspace customization, fostering innovation and efficiency in blockchain applications.

The restaking protocol of Solayer is akin to importing a library in programming, where developers can utilize pre-existing code to build applications more efficiently. This approach is considered the most economical way to secure future distributed systems. By restaking, Solayer ensures that validators, who are responsible for producing and voting on blocks, can enhance decentralization and secure the network more robustly. Validators play a crucial role in maintaining the integrity of the blockchain by ensuring that all transactions are legitimate and that no double-spending occurs.

Solayer's technology also introduces two significant value propositions. First, it secures exogenous AVSs, which refer to off-chain applications that can benefit from the security of the Solana network. Second, it provides stake-weighted Quality of Service (QoS) infrastructure for on-chain decentralized applications (dApps), known as endogenous AVSs. This means that applications running directly on the blockchain can achieve a higher degree of consensus and blockspace customization, allowing developers to tailor the blockchain's performance to their specific needs.

The shared validator network of Solayer enhances Solana's base layer security by allowing validators to participate in multiple networks simultaneously. This shared security model is crucial in preventing attacks from bad actors, as it increases the cost and complexity of attempting to compromise the network. By distributing the responsibility of validation across a wide array of participants, Solayer ensures that no single entity can gain control over the network, thus maintaining its decentralized nature.

sSOL, the liquid token on Solayer, unlocks a variety of decentralized finance (DeFi) use cases. It can be used for liquidity provisioning, collateral, and spot trading, among other applications. This versatility makes sSOL an integral part of the Solayer ecosystem, enabling users to engage in various financial activities while contributing to the network's security and efficiency.

Incorporating Solana's premium execution as a decentralized cloud infrastructure, Solayer allows for a higher degree of consensus and blockspace customization. This means that developers can create applications that are not only secure but also highly efficient and tailored to their specific requirements. By leveraging Solana's economic security, Solayer provides a robust platform for building and deploying decentralized applications that can operate at scale.

The technology behind Solayer SOL is a testament to the innovative use of blockchain principles to enhance security, efficiency, and functionality. By integrating restaking protocols and shared validator networks, Solayer offers a comprehensive solution for securing and optimizing blockchain applications, making it a pivotal player in the evolving landscape of decentralized finance and blockchain technology.

One of the standout features of Solayer SOL is its shared validator network. This network enhances security and bandwidth across Solana and other decentralized networks, making it an attractive option for developers looking to build decentralized applications (dApps). The shared validator network ensures that applications can operate with increased security, which is essential for maintaining trust and reliability in decentralized systems.

Solayer SOL also provides a stake-weighted Quality of Service (QoS) infrastructure for on-chain decentralized applications, known as Endogenous AVSs. This infrastructure allows developers to customize their applications' performance based on the amount of sSOL staked, offering a flexible and efficient way to manage resources.

Additionally, sSOL is a liquid token that unlocks various DeFi use cases. It can be used for liquidity provisioning, collateral, and spot trading, providing users with multiple avenues to engage with the decentralized finance ecosystem. This versatility makes sSOL a valuable asset for those looking to participate in DeFi activities on the Solana network.

At the time of writing, Solayer SOL's applications are specific to its restaking protocol, shared validator network, and DeFi use cases, with no other real-world applications identified.

One of the pivotal moments for Solayer SOL was its launch on the Solana network. This strategic move capitalized on Solana's reputation for speed and scalability, positioning Solayer as a key protocol within this burgeoning blockchain environment. By leveraging Solana's infrastructure, Solayer introduced a restaking mechanism that provides economic security for future distributed systems, akin to importing a library for efficient Proof of Stake (PoS) security.

Solayer's integration with other protocols marked another significant development. This integration facilitated the expansion of its ecosystem, enabling seamless interoperability with various decentralized applications (dApps). The protocol's ability to secure both exogenous and endogenous Application Virtual Spaces (AVSs) underscores its versatility. Exogenous AVSs refer to off-chain applications, while endogenous AVSs pertain to on-chain dApps, both benefiting from Solayer's stake-weighted Quality of Service (QoS) infrastructure.

The formation of strategic partnerships has further bolstered Solayer SOL's position in the market. Collaborations with prominent entities such as Binance and MathWallet have expanded its reach and utility, enhancing its appeal to a broader audience. These partnerships have not only increased the visibility of Solayer SOL but also facilitated its integration into various DeFi ecosystems, unlocking new use cases for its liquid token, sSOL.

In addition to these partnerships, Solayer SOL has seen a rise in market cap and trading volume, reflecting growing investor interest and confidence in its potential. This growth is indicative of the protocol's expanding influence and the increasing adoption of its restaking solutions within the cryptocurrency community.

Recent funding rounds have provided Solayer SOL with the resources necessary for further development and expansion. These financial injections are set to fuel the protocol's ambitious plans, which include enhancing its infrastructure and broadening its suite of services. The focus on staking and infrastructure for developers remains central to Solayer's strategy, as it continues to innovate and adapt to the evolving needs of the blockchain space.

Solayer SOL's journey is characterized by its commitment to providing a secure and efficient platform for developers, leveraging Solana's capabilities to deliver a unique restaking protocol. As it continues to evolve, Solayer SOL remains a significant entity within the cryptocurrency sector, driven by its strategic initiatives and robust technological foundation.

This is done with 2 approaches: a) Restaking is the most economical way to secure future distributed systems. Think of it as importing a library to create an economically secure POS efficiently.

b) Solayer restaking has two value propositions: i. Securing exogenous AVSs, which are off-chain applications. ii. Providing stake-weighted Quality of Service (QoS) Infrastructure for on-chain dApps (Endogenous AVSs)

sSOL is a liquid token on Solayer that unlocks a range of DeFi use cases such as liquidity provisioning, collateral, and spot trading.

What is Solayer SOL?

Solayer SOL (sSOL) emerges as a restaking protocol intricately woven into the Solana blockchain, offering a unique blend of enhanced network bandwidth and fortified Layer 1 security. This innovative protocol is designed to empower decentralized applications (dApps) by leveraging Solana's robust economic security and high-performance execution capabilities. Solayer's approach to restaking is akin to importing a library, facilitating the creation of economically secure proof-of-stake systems efficiently.The protocol's dual value propositions are noteworthy. Firstly, it secures exogenous application-specific validators (AVSs), which are off-chain applications, ensuring their integrity and reliability. Secondly, it provides a stake-weighted Quality of Service (QoS) infrastructure for on-chain dApps, known as endogenous AVSs, thereby optimizing their performance and reliability.

sSOL, the liquid token of Solayer, unlocks a myriad of decentralized finance (DeFi) opportunities. It serves as a versatile asset for liquidity provisioning, collateral, and spot trading, enhancing the financial ecosystem within the Solana network. By integrating decentralized cloud infrastructure, Solayer SOL offers developers a platform for consensus and blockspace customization, fostering innovation and efficiency in blockchain applications.

What is the technology behind Solayer SOL?

Solayer SOL (sSOL) operates on a restaking protocol built natively on the Solana blockchain, a platform known for its high-speed transactions and low fees. This protocol is designed to enhance the security and efficiency of Solana's network by leveraging the economic principles of staking. In a blockchain, staking involves holding a cryptocurrency in a wallet to support the operations of the network, such as validating transactions and securing the network. Solayer takes this concept further by allowing Solana-centric networks to share Solana's security and infrastructure, which not only bolsters the network's security but also provides additional yield for those who stake their tokens.The restaking protocol of Solayer is akin to importing a library in programming, where developers can utilize pre-existing code to build applications more efficiently. This approach is considered the most economical way to secure future distributed systems. By restaking, Solayer ensures that validators, who are responsible for producing and voting on blocks, can enhance decentralization and secure the network more robustly. Validators play a crucial role in maintaining the integrity of the blockchain by ensuring that all transactions are legitimate and that no double-spending occurs.

Solayer's technology also introduces two significant value propositions. First, it secures exogenous AVSs, which refer to off-chain applications that can benefit from the security of the Solana network. Second, it provides stake-weighted Quality of Service (QoS) infrastructure for on-chain decentralized applications (dApps), known as endogenous AVSs. This means that applications running directly on the blockchain can achieve a higher degree of consensus and blockspace customization, allowing developers to tailor the blockchain's performance to their specific needs.

The shared validator network of Solayer enhances Solana's base layer security by allowing validators to participate in multiple networks simultaneously. This shared security model is crucial in preventing attacks from bad actors, as it increases the cost and complexity of attempting to compromise the network. By distributing the responsibility of validation across a wide array of participants, Solayer ensures that no single entity can gain control over the network, thus maintaining its decentralized nature.

sSOL, the liquid token on Solayer, unlocks a variety of decentralized finance (DeFi) use cases. It can be used for liquidity provisioning, collateral, and spot trading, among other applications. This versatility makes sSOL an integral part of the Solayer ecosystem, enabling users to engage in various financial activities while contributing to the network's security and efficiency.

Incorporating Solana's premium execution as a decentralized cloud infrastructure, Solayer allows for a higher degree of consensus and blockspace customization. This means that developers can create applications that are not only secure but also highly efficient and tailored to their specific requirements. By leveraging Solana's economic security, Solayer provides a robust platform for building and deploying decentralized applications that can operate at scale.

The technology behind Solayer SOL is a testament to the innovative use of blockchain principles to enhance security, efficiency, and functionality. By integrating restaking protocols and shared validator networks, Solayer offers a comprehensive solution for securing and optimizing blockchain applications, making it a pivotal player in the evolving landscape of decentralized finance and blockchain technology.

What are the real-world applications of Solayer SOL?

Solayer SOL (sSOL) is a cryptocurrency that plays a pivotal role in enhancing the Solana network's capabilities. It is primarily known for its restaking protocol, which is built natively on Solana. This protocol allows users to restake various assets like SOL, mSOL, and JitoSOL, thereby contributing to the network's security and efficiency. By leveraging Solana's economic security and decentralized cloud infrastructure, Solayer enables a higher degree of consensus and blockspace customization, which is crucial for application developers.One of the standout features of Solayer SOL is its shared validator network. This network enhances security and bandwidth across Solana and other decentralized networks, making it an attractive option for developers looking to build decentralized applications (dApps). The shared validator network ensures that applications can operate with increased security, which is essential for maintaining trust and reliability in decentralized systems.

Solayer SOL also provides a stake-weighted Quality of Service (QoS) infrastructure for on-chain decentralized applications, known as Endogenous AVSs. This infrastructure allows developers to customize their applications' performance based on the amount of sSOL staked, offering a flexible and efficient way to manage resources.

Additionally, sSOL is a liquid token that unlocks various DeFi use cases. It can be used for liquidity provisioning, collateral, and spot trading, providing users with multiple avenues to engage with the decentralized finance ecosystem. This versatility makes sSOL a valuable asset for those looking to participate in DeFi activities on the Solana network.

At the time of writing, Solayer SOL's applications are specific to its restaking protocol, shared validator network, and DeFi use cases, with no other real-world applications identified.

What key events have there been for Solayer SOL?

Solayer SOL (sSOL) has emerged as a notable player in the cryptocurrency landscape, particularly within the Solana ecosystem. As a restaking protocol, Solayer is built to harness Solana's robust economic security and high-performance execution capabilities. This foundation allows Solayer to offer enhanced consensus and blockspace customization, catering specifically to application developers seeking efficient and secure decentralized cloud infrastructure.One of the pivotal moments for Solayer SOL was its launch on the Solana network. This strategic move capitalized on Solana's reputation for speed and scalability, positioning Solayer as a key protocol within this burgeoning blockchain environment. By leveraging Solana's infrastructure, Solayer introduced a restaking mechanism that provides economic security for future distributed systems, akin to importing a library for efficient Proof of Stake (PoS) security.

Solayer's integration with other protocols marked another significant development. This integration facilitated the expansion of its ecosystem, enabling seamless interoperability with various decentralized applications (dApps). The protocol's ability to secure both exogenous and endogenous Application Virtual Spaces (AVSs) underscores its versatility. Exogenous AVSs refer to off-chain applications, while endogenous AVSs pertain to on-chain dApps, both benefiting from Solayer's stake-weighted Quality of Service (QoS) infrastructure.

The formation of strategic partnerships has further bolstered Solayer SOL's position in the market. Collaborations with prominent entities such as Binance and MathWallet have expanded its reach and utility, enhancing its appeal to a broader audience. These partnerships have not only increased the visibility of Solayer SOL but also facilitated its integration into various DeFi ecosystems, unlocking new use cases for its liquid token, sSOL.

In addition to these partnerships, Solayer SOL has seen a rise in market cap and trading volume, reflecting growing investor interest and confidence in its potential. This growth is indicative of the protocol's expanding influence and the increasing adoption of its restaking solutions within the cryptocurrency community.

Recent funding rounds have provided Solayer SOL with the resources necessary for further development and expansion. These financial injections are set to fuel the protocol's ambitious plans, which include enhancing its infrastructure and broadening its suite of services. The focus on staking and infrastructure for developers remains central to Solayer's strategy, as it continues to innovate and adapt to the evolving needs of the blockchain space.

Solayer SOL's journey is characterized by its commitment to providing a secure and efficient platform for developers, leveraging Solana's capabilities to deliver a unique restaking protocol. As it continues to evolve, Solayer SOL remains a significant entity within the cryptocurrency sector, driven by its strategic initiatives and robust technological foundation.

Who are the founders of Solayer SOL?

Solayer (sSOL) emerges as a restaking protocol on Solana, designed to enhance consensus and blockspace customization for developers. The minds behind Solayer are Jason Li and Rachel Chu. Jason Li, known for his expertise in blockchain technology, plays a pivotal role in the technical development of Solayer, leveraging Solana's infrastructure. Rachel Chu, with a background in decentralized finance, focuses on strategic partnerships and expanding Solayer's ecosystem. Together, they aim to provide a robust platform for securing off-chain applications and offering quality infrastructure for on-chain decentralized applications.Related Articles

Solayer Genesis Drop Introduces $LAYER: How to Check Eligibility, TGE and Listing Date| Website | solayer.org/ |

| Website | docs.solayer.org/assets/ssol/overview#introduction-to-ssol |

| Socials | twitter.com/solayer_labs |

| Socials | github.com/solayer-labs |

| Socials | t.me/solayer_discussion |

| Contracts | sSo14e...GJywEh |

| Explorers | solscan.io/token/sSo14endRuUbvQaJS3dq36Q829a3A6BEfoeeRGJywEh |

| Wallets | www.trustwallet.com/ |

| Wallets | solflare.com/ |

| Wallets | backpack.app/downloads |

| Wallets | phantom.app/ |