Silo brings isolated lending markets to all token assets in the same way Uniswap brought liquidity pools to thousands of tokens. Users are able to use any token as collateral.

Silo is secure, efficient, and inclusive. The impact of a token being exploited, or manipulated, is isolated to the respective market, rather than the protocol.

Each lending silo supports two assets only; the bridge token and a unique token. This design concentrates liquidity in single pools and allows for efficiency. Silo's markets are permissionless and therefore any token asset can have a borrow/lend market.

Each lending silo within the platform supports two assets: a bridge token and a unique token. This design not only concentrates liquidity but also maximizes efficiency, making it easier for users to find and utilize lending opportunities. The protocol's permissionless nature means that any token asset can establish a borrow/lend market, democratizing access to decentralized finance.

Silo Finance operates without oversight or control over any specific crypto asset, blockchain network, or the protocol itself. This decentralized approach ensures that the platform remains inclusive and adaptable, supporting a wide range of token assets across various blockchain networks. By bringing isolated lending markets to all token assets, Silo Finance mirrors the way Uniswap introduced liquidity pools to thousands of tokens, fostering a more secure and efficient DeFi ecosystem.

Silo Finance was founded in 2018 with the aim of becoming a leading lending protocol in the crypto space. One of the standout features of Silo Finance is its use of isolated risk and shared liquidity. This means that the impact of a token being exploited or manipulated is confined to the respective market, rather than affecting the entire protocol. This design enhances security and efficiency, making Silo Finance a robust platform for lending and borrowing.

Each lending silo within the Silo Protocol supports two assets only: the bridge token and a unique token. This design concentrates liquidity in single pools, allowing for greater efficiency. By isolating lending markets for all token assets, Silo Finance brings a level of security and inclusivity that is comparable to how Uniswap brought liquidity pools to thousands of tokens. Users can use any token as collateral, which broadens the scope of assets that can participate in the lending markets.

The blockchain on which Silo Finance operates employs various mechanisms to prevent attacks from bad actors. One such mechanism is the use of isolated risk, which ensures that any potential exploit or manipulation is contained within a specific market, thereby protecting the overall protocol. Additionally, the decentralized nature of the protocol means that there is no single point of failure, further enhancing security.

Silo Finance's markets are permissionless, meaning that any token asset can have a borrow/lend market. This inclusivity allows for a wide range of assets to be utilized within the protocol, providing users with more options and flexibility. The protocol's design also ensures that liquidity is concentrated in single pools, which enhances efficiency and reduces the risk of liquidity fragmentation.

The Silo Protocol also incorporates advanced cryptographic techniques and consensus mechanisms to maintain the integrity and security of the blockchain. These techniques ensure that transactions are securely recorded and that the protocol operates smoothly without interference from malicious actors. The use of smart contracts further automates and secures the lending and borrowing processes, reducing the need for intermediaries and increasing transparency.

In addition to its technical features, Silo Finance places a strong emphasis on community governance. This decentralized governance model allows users to participate in decision-making processes, ensuring that the protocol evolves in a way that aligns with the interests of its users. This participatory approach not only fosters a sense of ownership among users but also helps in the continuous improvement and adaptation of the protocol to meet the changing needs of the market.

The combination of isolated risk, shared liquidity, permissionless markets, and advanced cryptographic techniques makes Silo Finance a secure, efficient, and inclusive platform for decentralized lending and borrowing. By supporting a wide range of token assets and providing robust security measures, Silo Finance aims to create a more resilient and accessible financial ecosystem for users around the world.

One of the standout features of Silo Finance is its risk-isolated lending markets. This means that each lending market, or "silo," supports only two assets: a bridge token and a unique token. This design ensures that any potential exploit or manipulation is contained within the specific market, safeguarding the broader protocol. Such a structure not only enhances security but also promotes efficiency by concentrating liquidity in single pools.

Silo Finance also champions permissionless borrowing, allowing any token asset to have its own borrow/lend market. This inclusivity mirrors the way Uniswap revolutionized liquidity pools for numerous tokens, making Silo Finance a versatile platform for users seeking diverse financial interactions. The protocol's emphasis on breaking down data silos further encourages collaboration within the crypto industry, fostering a more interconnected ecosystem.

Additionally, Silo Finance provides a modern financing experience by enabling users to deposit base assets and borrow bridged assets. This functionality is supported by a total value locked (TVL) of over $157 million, reflecting the trust and adoption it has garnered within the DeFi community. With a focus on code security and cybersecurity, Silo Finance is built by a team dedicated to ensuring a robust and reliable platform for its users.

One of the pivotal moments for Silo Finance was the launch of their open-source software. This move underscored their commitment to transparency and community involvement, allowing developers to contribute to and enhance the protocol's functionality. The open-source nature of Silo Finance has fostered a robust development environment, as evidenced by their active GitHub repositories.

Silo Finance also made a significant impact with the development of their decentralized finance services. By creating permissionless markets where any token asset can have a borrow/lend market, Silo Finance has democratized access to DeFi. Each lending silo supports two assets: the bridge token and a unique token, concentrating liquidity in single pools for greater efficiency.

In the realm of community engagement, Silo Finance has established a strong online presence. Their Twitter account and Discord community serve as vital platforms for updates, discussions, and user support. This active engagement has helped build a loyal user base and fostered a sense of community around the protocol.

A notable strategic move was the creation of a proposal to build a $SILO pool on Curve V2. This proposal aimed to integrate Silo Finance more deeply into the DeFi ecosystem by leveraging Curve's liquidity infrastructure. The plan to incentivize liquidity through CRV emissions was another key aspect of this strategy, designed to attract more users and liquidity providers to the Silo Finance platform.

In December 2022, Silo Finance continued to refine their terms and conditions, reflecting their ongoing commitment to regulatory compliance and user protection. This update was part of their broader strategy to ensure that their platform remains secure and trustworthy for all users.

Silo Finance's aggressive growth strategy has been another defining feature of their journey. By continuously innovating and expanding their offerings, they have positioned themselves as a significant player in the DeFi space. This strategy has included partnerships, technological advancements, and community-building efforts, all aimed at enhancing the protocol's value proposition.

The combination of these key events has solidified Silo Finance's reputation as a secure, efficient, and inclusive DeFi protocol. Their unique approach to isolated lending markets and commitment to community engagement and transparency has set them apart in the competitive world of decentralized finance.

Silo is secure, efficient, and inclusive. The impact of a token being exploited, or manipulated, is isolated to the respective market, rather than the protocol.

Each lending silo supports two assets only; the bridge token and a unique token. This design concentrates liquidity in single pools and allows for efficiency. Silo's markets are permissionless and therefore any token asset can have a borrow/lend market.

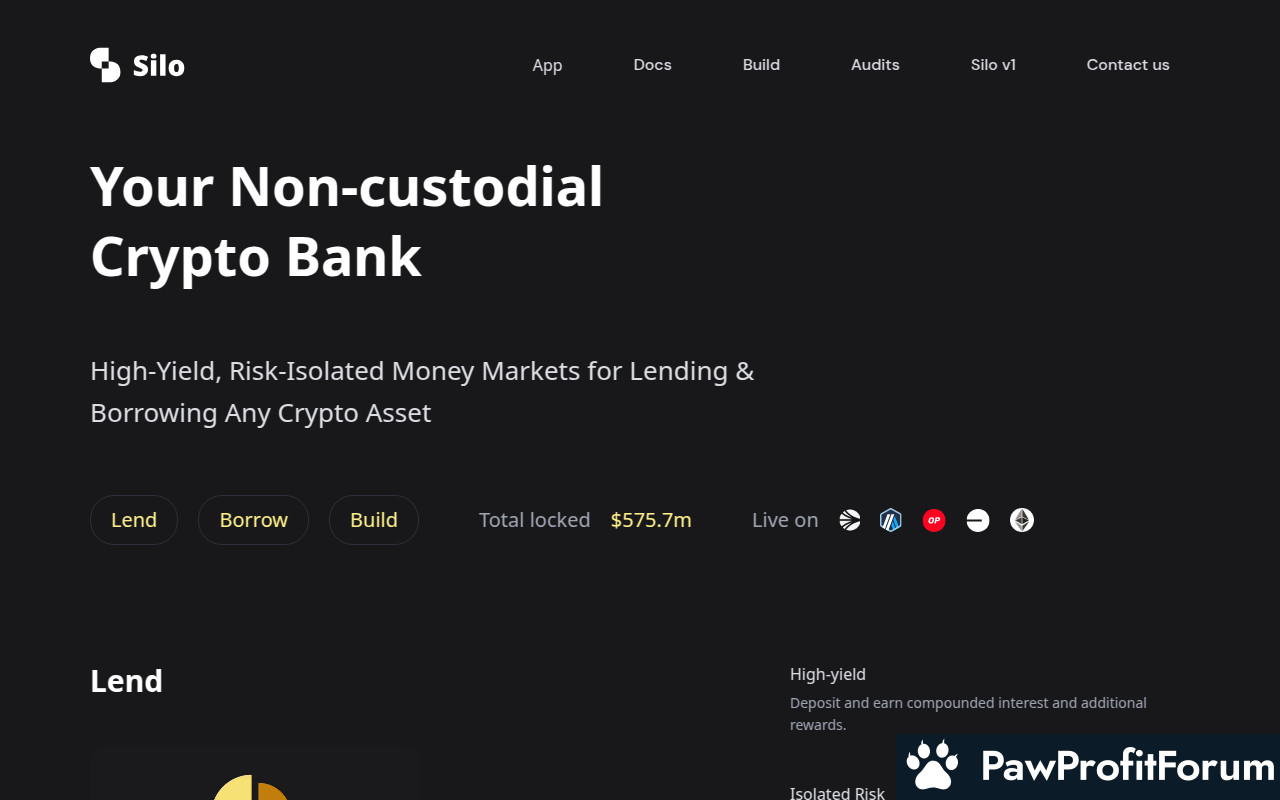

What is Silo Finance?

Silo Finance (SILO) redefines the landscape of decentralized finance by offering a non-custodial lending protocol that allows users to borrow any crypto asset using another as collateral. Unlike traditional lending platforms, Silo Finance isolates lending markets, ensuring that the impact of any token exploitation or manipulation is confined to its respective market. This innovative approach enhances security and stability across the protocol.Each lending silo within the platform supports two assets: a bridge token and a unique token. This design not only concentrates liquidity but also maximizes efficiency, making it easier for users to find and utilize lending opportunities. The protocol's permissionless nature means that any token asset can establish a borrow/lend market, democratizing access to decentralized finance.

Silo Finance operates without oversight or control over any specific crypto asset, blockchain network, or the protocol itself. This decentralized approach ensures that the platform remains inclusive and adaptable, supporting a wide range of token assets across various blockchain networks. By bringing isolated lending markets to all token assets, Silo Finance mirrors the way Uniswap introduced liquidity pools to thousands of tokens, fostering a more secure and efficient DeFi ecosystem.

What is the technology behind Silo Finance?

The technology behind Silo Finance, represented by the ticker SILO, is rooted in the Silo Protocol, a decentralized and autonomous interest rate market and informational feed. This protocol operates in a decentralized manner, supporting any token asset on the chains it operates on. The core of Silo Finance's technology is its permissionless, risk-isolating lending protocol, which ensures deposit security and fluidity for various token assets.Silo Finance was founded in 2018 with the aim of becoming a leading lending protocol in the crypto space. One of the standout features of Silo Finance is its use of isolated risk and shared liquidity. This means that the impact of a token being exploited or manipulated is confined to the respective market, rather than affecting the entire protocol. This design enhances security and efficiency, making Silo Finance a robust platform for lending and borrowing.

Each lending silo within the Silo Protocol supports two assets only: the bridge token and a unique token. This design concentrates liquidity in single pools, allowing for greater efficiency. By isolating lending markets for all token assets, Silo Finance brings a level of security and inclusivity that is comparable to how Uniswap brought liquidity pools to thousands of tokens. Users can use any token as collateral, which broadens the scope of assets that can participate in the lending markets.

The blockchain on which Silo Finance operates employs various mechanisms to prevent attacks from bad actors. One such mechanism is the use of isolated risk, which ensures that any potential exploit or manipulation is contained within a specific market, thereby protecting the overall protocol. Additionally, the decentralized nature of the protocol means that there is no single point of failure, further enhancing security.

Silo Finance's markets are permissionless, meaning that any token asset can have a borrow/lend market. This inclusivity allows for a wide range of assets to be utilized within the protocol, providing users with more options and flexibility. The protocol's design also ensures that liquidity is concentrated in single pools, which enhances efficiency and reduces the risk of liquidity fragmentation.

The Silo Protocol also incorporates advanced cryptographic techniques and consensus mechanisms to maintain the integrity and security of the blockchain. These techniques ensure that transactions are securely recorded and that the protocol operates smoothly without interference from malicious actors. The use of smart contracts further automates and secures the lending and borrowing processes, reducing the need for intermediaries and increasing transparency.

In addition to its technical features, Silo Finance places a strong emphasis on community governance. This decentralized governance model allows users to participate in decision-making processes, ensuring that the protocol evolves in a way that aligns with the interests of its users. This participatory approach not only fosters a sense of ownership among users but also helps in the continuous improvement and adaptation of the protocol to meet the changing needs of the market.

The combination of isolated risk, shared liquidity, permissionless markets, and advanced cryptographic techniques makes Silo Finance a secure, efficient, and inclusive platform for decentralized lending and borrowing. By supporting a wide range of token assets and providing robust security measures, Silo Finance aims to create a more resilient and accessible financial ecosystem for users around the world.

What are the real-world applications of Silo Finance?

Silo Finance (SILO) emerges as a decentralized, non-custodial lending protocol designed to offer secure and efficient money markets for all crypto assets. Its innovative approach to decentralized finance (DeFi) allows users to engage in borrowing and lending activities using a wide range of crypto assets. Unlike traditional finance systems, Silo Finance enables users to use any token as collateral, thereby expanding the possibilities for asset utilization across blockchain networks.One of the standout features of Silo Finance is its risk-isolated lending markets. This means that each lending market, or "silo," supports only two assets: a bridge token and a unique token. This design ensures that any potential exploit or manipulation is contained within the specific market, safeguarding the broader protocol. Such a structure not only enhances security but also promotes efficiency by concentrating liquidity in single pools.

Silo Finance also champions permissionless borrowing, allowing any token asset to have its own borrow/lend market. This inclusivity mirrors the way Uniswap revolutionized liquidity pools for numerous tokens, making Silo Finance a versatile platform for users seeking diverse financial interactions. The protocol's emphasis on breaking down data silos further encourages collaboration within the crypto industry, fostering a more interconnected ecosystem.

Additionally, Silo Finance provides a modern financing experience by enabling users to deposit base assets and borrow bridged assets. This functionality is supported by a total value locked (TVL) of over $157 million, reflecting the trust and adoption it has garnered within the DeFi community. With a focus on code security and cybersecurity, Silo Finance is built by a team dedicated to ensuring a robust and reliable platform for its users.

What key events have there been for Silo Finance?

Silo Finance, a decentralized finance (DeFi) protocol, has made significant strides in the blockchain and cryptocurrency space. Known for bringing isolated lending markets to various token assets, Silo Finance allows users to use any token as collateral, ensuring security, efficiency, and inclusivity. The protocol's design isolates the impact of token exploits or manipulations to their respective markets, rather than affecting the entire protocol.One of the pivotal moments for Silo Finance was the launch of their open-source software. This move underscored their commitment to transparency and community involvement, allowing developers to contribute to and enhance the protocol's functionality. The open-source nature of Silo Finance has fostered a robust development environment, as evidenced by their active GitHub repositories.

Silo Finance also made a significant impact with the development of their decentralized finance services. By creating permissionless markets where any token asset can have a borrow/lend market, Silo Finance has democratized access to DeFi. Each lending silo supports two assets: the bridge token and a unique token, concentrating liquidity in single pools for greater efficiency.

In the realm of community engagement, Silo Finance has established a strong online presence. Their Twitter account and Discord community serve as vital platforms for updates, discussions, and user support. This active engagement has helped build a loyal user base and fostered a sense of community around the protocol.

A notable strategic move was the creation of a proposal to build a $SILO pool on Curve V2. This proposal aimed to integrate Silo Finance more deeply into the DeFi ecosystem by leveraging Curve's liquidity infrastructure. The plan to incentivize liquidity through CRV emissions was another key aspect of this strategy, designed to attract more users and liquidity providers to the Silo Finance platform.

In December 2022, Silo Finance continued to refine their terms and conditions, reflecting their ongoing commitment to regulatory compliance and user protection. This update was part of their broader strategy to ensure that their platform remains secure and trustworthy for all users.

Silo Finance's aggressive growth strategy has been another defining feature of their journey. By continuously innovating and expanding their offerings, they have positioned themselves as a significant player in the DeFi space. This strategy has included partnerships, technological advancements, and community-building efforts, all aimed at enhancing the protocol's value proposition.

The combination of these key events has solidified Silo Finance's reputation as a secure, efficient, and inclusive DeFi protocol. Their unique approach to isolated lending markets and commitment to community engagement and transparency has set them apart in the competitive world of decentralized finance.

Who are the founders of Silo Finance?

Silo Finance, symbolized by SILO, revolutionizes lending markets by isolating them for each token asset, akin to how Uniswap introduced liquidity pools for numerous tokens. Users can leverage any token as collateral, ensuring security and efficiency. The founder of Silo Finance in the cryptocurrency realm is Aiham Jaabari. Despite extensive searches, no additional information about other founders or their backgrounds is available from the provided sources. This lack of detailed founder information leaves Aiham Jaabari as the primary known figure behind Silo Finance.| Website | www.silo.finance/ |

| Website | devdocs.silo.finance/ |

| Socials | twitter.com/SiloFinance |

| Socials | github.com/silo-finance |

| Socials | discord.gg/silo-finance |

| Contracts | 0x6f80...8ab1f8 |

| Explorers | etherscan.io/token/0x6f80310ca7f2c654691d1383149fa1a57d8ab1f8 |

| Wallets | metamask.io/ |