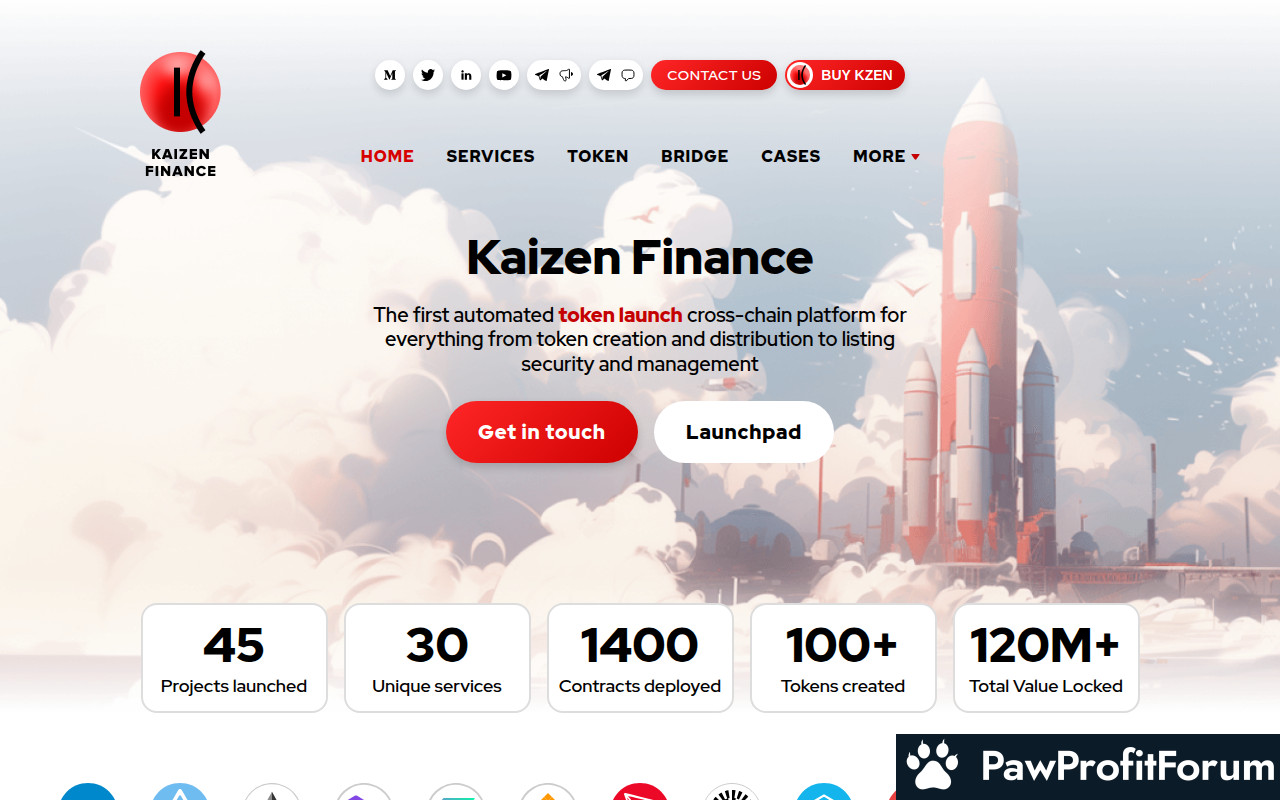

Kaizen Finance is a token lifecycle management platform for token creation and management, boosting project fair launch and letting Kaizen.Finance community to invest in top-notch projects

It gives any project a no-code solution to manage tokens from point zero and right to the moon: - Cross-chain token creation with embedded security traits - Vesting schedule automation/distribution + smart contracts deployment - Pre-Sale smart contract and deployment - Get automated token audit - Sniping bot, frontrunning, DDoS protection - Fair Launch, market-making - Staking smart contract of vested and original tokens - Liquidity Pool tokens lock for rugpull-protection - Company vested tokens listing on kDEX - and much much more

At its core, Kaizen Finance facilitates cross-chain token creation, embedding essential security traits to safeguard digital assets. The platform automates vesting schedules and distribution, deploying smart contracts to streamline these processes. Pre-sale smart contract deployment is another key feature, enabling projects to launch tokens seamlessly.

Security is a paramount concern for Kaizen Finance. The platform offers automated token audits and protection against sniping bots, frontrunning, and DDoS attacks. This ensures a fair launch and market-making process, bolstering investor confidence.

Staking is another critical component, with smart contracts managing both vested and original tokens. Liquidity pool tokens are locked to prevent rug pulls, adding an extra layer of security. Additionally, company vested tokens can be listed on kDEX, enhancing liquidity and market access.

Kaizen Finance also supports custom projects, RWA tokenization, and launchpads, making it a versatile tool for various blockchain initiatives. With a strong social media presence and participation in industry events, Kaizen Finance continues to be a pivotal player in the cryptocurrency space.

One of the standout features of Kaizen Finance is its no-code solution for token management. This means that even those without technical expertise can create and manage tokens from inception to full deployment. The platform incorporates embedded security traits in the token creation process, ensuring that tokens are secure from the very beginning. This is crucial for maintaining the integrity and trustworthiness of the tokens being launched.

Kaizen Finance also automates the vesting schedule and distribution of tokens. Vesting schedules are essential for ensuring that tokens are released in a controlled manner over time, which helps prevent market flooding and maintains token value. The platform uses smart contracts to automate this process, making it both efficient and transparent. These smart contracts are also used for pre-sale deployments, ensuring that the terms of the token sale are enforced automatically.

Security is a paramount concern for any blockchain-based platform, and Kaizen Finance addresses this with several robust measures. The platform includes automated token audits to identify and mitigate potential vulnerabilities. Additionally, it offers protection against sniping bots, frontrunning, and Distributed Denial of Service (DDoS) attacks. These protections are critical for maintaining the stability and security of the platform, especially during high-traffic events like token launches.

Kaizen Finance also supports fair launches and market-making activities. Fair launches ensure that all participants have an equal opportunity to acquire tokens, which helps build a more equitable and engaged community. Market-making activities are facilitated to provide liquidity and stability for the tokens, which is essential for their long-term success.

Staking is another important feature of Kaizen Finance. The platform allows for the staking of both vested and original tokens through smart contracts. Staking can provide additional incentives for token holders, encouraging them to hold onto their tokens and participate in the network. This can help increase the overall stability and value of the token ecosystem.

To prevent rug pulls, where developers abandon a project and take investors' funds, Kaizen Finance locks liquidity pool tokens. This ensures that the liquidity provided for the tokens cannot be easily withdrawn, providing an additional layer of security for investors. Furthermore, company vested tokens can be listed on kDEX, Kaizen Finance's decentralized exchange, providing a secure and transparent marketplace for trading these tokens.

The platform's comprehensive approach to token lifecycle management, from creation to market deployment, is designed to support the success of blockchain projects. By offering a wide range of automated and secure features, Kaizen Finance aims to make the process of launching and managing tokens as seamless and efficient as possible.

Another significant application is the automation of vesting schedules and distribution. This feature allows projects to set up and manage the release of tokens over time, ensuring that stakeholders receive their tokens according to predefined schedules. Additionally, Kaizen Finance facilitates the deployment of smart contracts, which are essential for automating various processes within a blockchain ecosystem.

Kaizen Finance also provides tools for pre-sale smart contract deployment, enabling projects to conduct token sales efficiently and securely. The platform includes automated token audits, which help ensure that tokens meet security and compliance standards before they are released to the market. This is crucial for maintaining investor confidence and regulatory compliance.

For projects concerned about security, Kaizen Finance offers protection against sniping bots, frontrunning, and DDoS attacks. These features help safeguard the integrity of token sales and trading activities. The platform also supports fair launch mechanisms and market-making, which are essential for establishing a stable and liquid market for newly created tokens.

Staking is another key application of Kaizen Finance. The platform allows for the staking of both vested and original tokens, providing users with opportunities to earn rewards while supporting the network. Additionally, Kaizen Finance includes liquidity pool token locking for rug pull protection, ensuring that liquidity providers are safeguarded against malicious activities.

Kaizen Finance also supports the listing of company vested tokens on its decentralized exchange (kDEX), providing a marketplace for trading and liquidity. The platform's community sale flow enables projects to engage with their community and raise funds in a decentralized manner.

Real-world applications of Kaizen Finance extend to improving business processes, customer experience, and profitability. It has been successfully implemented by companies such as Toyota, Sony, Canon, and Honda to enhance their operations. The platform's tools for assessing social presence and community-building efforts further support projects in establishing a strong market presence.

On August 27, 2022, Kaizen Finance officially launched, marking a significant milestone in its journey. This launch introduced its automated token launch platform, which has since garnered attention for its innovative approach to token lifecycle management.

Earlier, on September 30, 2021, Kaizen Finance participated in a Latoken event. This participation helped the platform gain visibility and connect with a broader audience within the cryptocurrency community. The event underscored Kaizen Finance's commitment to engaging with industry stakeholders and promoting its solutions.

In the same year, on November 22, 2021, Kaizen Finance initiated its community sale. This event was crucial for raising funds and building a strong community of supporters and investors. The community sale allowed participants to invest in the platform's vision and contribute to its growth.

Additionally, on September 10, 2021, Kaizen Finance announced new opportunities for community-building efforts. This announcement highlighted the platform's focus on fostering a vibrant and engaged community, which is essential for the long-term success of any cryptocurrency project.

Kaizen Finance's automated token audit feature ensures that tokens created on the platform meet high-security standards. This feature is part of the platform's broader commitment to providing a secure and reliable environment for token management. The platform also offers liquidity pool token locks to protect against rug pulls, further enhancing its security credentials.

The introduction of staking smart contracts for vested and original tokens has provided users with more options for earning rewards and participating in the ecosystem. This feature aligns with Kaizen Finance's goal of creating a comprehensive and user-friendly platform for token management.

Kaizen Finance's listing of company vested tokens on kDEX has added another layer of utility to the platform. This listing allows projects to manage their tokens more effectively and provides additional liquidity options for users.

Overall, Kaizen Finance has made significant progress in establishing itself as a key player in the token lifecycle management space. Its innovative features and commitment to security and community engagement have positioned it well for future growth and success in the cryptocurrency industry.

It gives any project a no-code solution to manage tokens from point zero and right to the moon: - Cross-chain token creation with embedded security traits - Vesting schedule automation/distribution + smart contracts deployment - Pre-Sale smart contract and deployment - Get automated token audit - Sniping bot, frontrunning, DDoS protection - Fair Launch, market-making - Staking smart contract of vested and original tokens - Liquidity Pool tokens lock for rugpull-protection - Company vested tokens listing on kDEX - and much much more

What is Kaizen Finance?

Kaizen Finance (KZEN) stands out as a comprehensive token lifecycle management platform, offering a suite of services that cater to the entire spectrum of token creation and management. This platform is designed to simplify the complexities of launching and managing tokens, providing a no-code solution that ensures security and efficiency from inception to market deployment.At its core, Kaizen Finance facilitates cross-chain token creation, embedding essential security traits to safeguard digital assets. The platform automates vesting schedules and distribution, deploying smart contracts to streamline these processes. Pre-sale smart contract deployment is another key feature, enabling projects to launch tokens seamlessly.

Security is a paramount concern for Kaizen Finance. The platform offers automated token audits and protection against sniping bots, frontrunning, and DDoS attacks. This ensures a fair launch and market-making process, bolstering investor confidence.

Staking is another critical component, with smart contracts managing both vested and original tokens. Liquidity pool tokens are locked to prevent rug pulls, adding an extra layer of security. Additionally, company vested tokens can be listed on kDEX, enhancing liquidity and market access.

Kaizen Finance also supports custom projects, RWA tokenization, and launchpads, making it a versatile tool for various blockchain initiatives. With a strong social media presence and participation in industry events, Kaizen Finance continues to be a pivotal player in the cryptocurrency space.

What is the technology behind Kaizen Finance?

The technology behind Kaizen Finance (KZEN) is a sophisticated, automated, cross-chain token lifecycle management platform. At its core, Kaizen Finance leverages blockchain technology to facilitate the creation, management, and distribution of tokens across multiple blockchain networks. This cross-chain capability ensures that tokens can be seamlessly launched and managed on different blockchains, providing flexibility and broad reach for projects and investors alike.One of the standout features of Kaizen Finance is its no-code solution for token management. This means that even those without technical expertise can create and manage tokens from inception to full deployment. The platform incorporates embedded security traits in the token creation process, ensuring that tokens are secure from the very beginning. This is crucial for maintaining the integrity and trustworthiness of the tokens being launched.

Kaizen Finance also automates the vesting schedule and distribution of tokens. Vesting schedules are essential for ensuring that tokens are released in a controlled manner over time, which helps prevent market flooding and maintains token value. The platform uses smart contracts to automate this process, making it both efficient and transparent. These smart contracts are also used for pre-sale deployments, ensuring that the terms of the token sale are enforced automatically.

Security is a paramount concern for any blockchain-based platform, and Kaizen Finance addresses this with several robust measures. The platform includes automated token audits to identify and mitigate potential vulnerabilities. Additionally, it offers protection against sniping bots, frontrunning, and Distributed Denial of Service (DDoS) attacks. These protections are critical for maintaining the stability and security of the platform, especially during high-traffic events like token launches.

Kaizen Finance also supports fair launches and market-making activities. Fair launches ensure that all participants have an equal opportunity to acquire tokens, which helps build a more equitable and engaged community. Market-making activities are facilitated to provide liquidity and stability for the tokens, which is essential for their long-term success.

Staking is another important feature of Kaizen Finance. The platform allows for the staking of both vested and original tokens through smart contracts. Staking can provide additional incentives for token holders, encouraging them to hold onto their tokens and participate in the network. This can help increase the overall stability and value of the token ecosystem.

To prevent rug pulls, where developers abandon a project and take investors' funds, Kaizen Finance locks liquidity pool tokens. This ensures that the liquidity provided for the tokens cannot be easily withdrawn, providing an additional layer of security for investors. Furthermore, company vested tokens can be listed on kDEX, Kaizen Finance's decentralized exchange, providing a secure and transparent marketplace for trading these tokens.

The platform's comprehensive approach to token lifecycle management, from creation to market deployment, is designed to support the success of blockchain projects. By offering a wide range of automated and secure features, Kaizen Finance aims to make the process of launching and managing tokens as seamless and efficient as possible.

What are the real-world applications of Kaizen Finance?

Kaizen Finance (KZEN) is a comprehensive token lifecycle management platform designed to streamline the creation and management of tokens. It offers a no-code solution for projects to manage tokens from inception to full deployment. One of its primary applications is cross-chain token creation, which includes embedded security features to ensure robust protection against potential threats.Another significant application is the automation of vesting schedules and distribution. This feature allows projects to set up and manage the release of tokens over time, ensuring that stakeholders receive their tokens according to predefined schedules. Additionally, Kaizen Finance facilitates the deployment of smart contracts, which are essential for automating various processes within a blockchain ecosystem.

Kaizen Finance also provides tools for pre-sale smart contract deployment, enabling projects to conduct token sales efficiently and securely. The platform includes automated token audits, which help ensure that tokens meet security and compliance standards before they are released to the market. This is crucial for maintaining investor confidence and regulatory compliance.

For projects concerned about security, Kaizen Finance offers protection against sniping bots, frontrunning, and DDoS attacks. These features help safeguard the integrity of token sales and trading activities. The platform also supports fair launch mechanisms and market-making, which are essential for establishing a stable and liquid market for newly created tokens.

Staking is another key application of Kaizen Finance. The platform allows for the staking of both vested and original tokens, providing users with opportunities to earn rewards while supporting the network. Additionally, Kaizen Finance includes liquidity pool token locking for rug pull protection, ensuring that liquidity providers are safeguarded against malicious activities.

Kaizen Finance also supports the listing of company vested tokens on its decentralized exchange (kDEX), providing a marketplace for trading and liquidity. The platform's community sale flow enables projects to engage with their community and raise funds in a decentralized manner.

Real-world applications of Kaizen Finance extend to improving business processes, customer experience, and profitability. It has been successfully implemented by companies such as Toyota, Sony, Canon, and Honda to enhance their operations. The platform's tools for assessing social presence and community-building efforts further support projects in establishing a strong market presence.

What key events have there been for Kaizen Finance?

Kaizen Finance, a token lifecycle management platform, has made notable strides in the cryptocurrency space. It offers a comprehensive suite of tools for token creation and management, including cross-chain token creation, vesting schedule automation, and pre-sale smart contract deployment. The platform aims to facilitate fair launches and provide robust security measures such as sniping bot protection and DDoS mitigation.On August 27, 2022, Kaizen Finance officially launched, marking a significant milestone in its journey. This launch introduced its automated token launch platform, which has since garnered attention for its innovative approach to token lifecycle management.

Earlier, on September 30, 2021, Kaizen Finance participated in a Latoken event. This participation helped the platform gain visibility and connect with a broader audience within the cryptocurrency community. The event underscored Kaizen Finance's commitment to engaging with industry stakeholders and promoting its solutions.

In the same year, on November 22, 2021, Kaizen Finance initiated its community sale. This event was crucial for raising funds and building a strong community of supporters and investors. The community sale allowed participants to invest in the platform's vision and contribute to its growth.

Additionally, on September 10, 2021, Kaizen Finance announced new opportunities for community-building efforts. This announcement highlighted the platform's focus on fostering a vibrant and engaged community, which is essential for the long-term success of any cryptocurrency project.

Kaizen Finance's automated token audit feature ensures that tokens created on the platform meet high-security standards. This feature is part of the platform's broader commitment to providing a secure and reliable environment for token management. The platform also offers liquidity pool token locks to protect against rug pulls, further enhancing its security credentials.

The introduction of staking smart contracts for vested and original tokens has provided users with more options for earning rewards and participating in the ecosystem. This feature aligns with Kaizen Finance's goal of creating a comprehensive and user-friendly platform for token management.

Kaizen Finance's listing of company vested tokens on kDEX has added another layer of utility to the platform. This listing allows projects to manage their tokens more effectively and provides additional liquidity options for users.

Overall, Kaizen Finance has made significant progress in establishing itself as a key player in the token lifecycle management space. Its innovative features and commitment to security and community engagement have positioned it well for future growth and success in the cryptocurrency industry.

Who are the founders of Kaizen Finance?

Kaizen Finance (KZEN) stands out as a comprehensive token lifecycle management platform, offering a suite of tools for token creation, management, and security. The masterminds behind this innovative project are Evgen Verzun and Laurie Klein. Evgen Verzun, known for his extensive experience in cybersecurity and blockchain technology, plays a pivotal role in the technical and strategic direction of Kaizen Finance. Laurie Klein, with a background in business development and finance, complements Verzun by focusing on the operational and growth aspects of the platform. Their combined expertise ensures that Kaizen Finance delivers robust solutions for token management and project launches.| Website | kaizen.finance |

| Website | kaizen.finance/assets/white-papers/The%20Kaizen%20Protocol%20Wite%20paper%20v4%202021.pdf |

| Socials | twitter.com/kaizen_finance |

| Socials | etherscan.io/address/0x4550003152F12014558e5CE025707E4DD841100F#readProxyContract |

| Socials | t.me/KaizenFinanceOfficial |

| Contracts | 0x4550...41100F |

| Explorers | solscan.io/token/kZEn3aDxEzcFADPe2VQ6WcJRbS1hVGjUcgCw4HiuYSU |

| Wallets | www.trustwallet.com/ |

| Wallets | metamask.io/ |

| Wallets | solflare.com/ |

| Wallets | backpack.app/downloads |