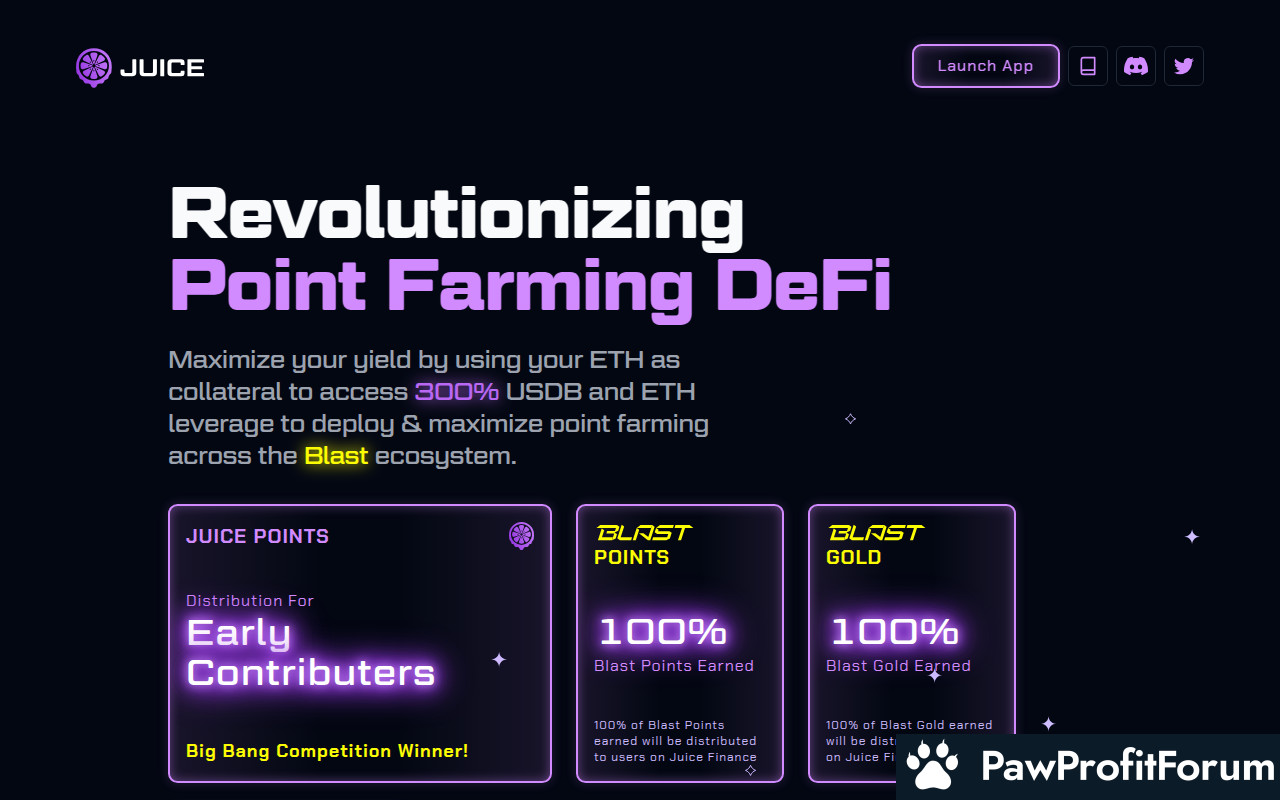

Juice Finance, is a leading disruptive Cross-Margin DeFi protocol built on the Blast L2. At its core, Juice innovates with cross-margin lending features, integrating seamlessly with Blast’s unique rebasing tokens and ecosystem ethos. Our platform is designed to empower users with composable leverage, enabling them to maximize their yield and point farming activities within the Blast ecosystem.

Built on the Blast L2 network, Juice Finance is not just another DeFi protocol; it is a Cross-Margin DeFi protocol designed to provide users with up to 300% USDB leverage. This feature allows for enhanced yields across the ecosystem, making it a powerful tool for those looking to maximize their returns. The platform's core innovation lies in its cross-margin lending capabilities, seamlessly integrating with Blast’s rebasing tokens and ecosystem ethos.

Juice Finance's composable leverage feature is particularly noteworthy. It enables users to maximize their yield and point farming activities, thereby enhancing their overall DeFi experience. The protocol's design ensures that users can interact with various DApps within the Blast ecosystem without the need for multiple collateral deposits, streamlining the process and making it more efficient.

In addition to its technical prowess, Juice Finance is designed to be user-friendly, ensuring that both novice and experienced users can navigate the platform with ease. The protocol's permissionless nature means that anyone can participate, democratizing access to advanced financial tools and opportunities.

The Blast L2 network employs advanced security measures to prevent attacks from bad actors. One of the key features is its use of native rebasing tokens, which adjust their supply automatically to maintain a stable value. This mechanism helps in mitigating risks associated with price volatility, making the platform more secure and reliable for users. Additionally, the Blast L2 network incorporates gas refund mechanics, which incentivize users by refunding a portion of the transaction fees, thereby encouraging more participation and enhancing network security through increased activity.

Juice Finance's Cross-Margin DeFi protocol is another innovative aspect of its technology. This protocol allows users to leverage their assets up to 300% in USDB, providing significant opportunities for yield maximization and point farming within the Blast ecosystem. The cross-margin feature ensures that users can manage their collateral more efficiently, reducing the risk of liquidation and enabling more strategic financial maneuvers.

The integration of customizable APIs further enhances the platform's versatility, allowing businesses to tailor the Juice Finance services to their specific needs. These APIs facilitate seamless interactions with other financial services and applications, making it easier for businesses to incorporate Juice Finance into their existing systems. This level of customization and integration is crucial for businesses looking to optimize their financial operations and leverage the benefits of decentralized finance (DeFi).

Moreover, Juice Finance's composable leverage feature empowers users to maximize their yield farming activities. By allowing users to stack multiple layers of leverage, the platform enables more complex and potentially more profitable strategies. This composability is a significant advantage for experienced DeFi users who are looking to optimize their returns through sophisticated financial techniques.

The Blast ecosystem's ethos of innovation and security is deeply embedded in Juice Finance's technology. The platform's design prioritizes user empowerment, providing tools and features that enable users to take full control of their financial activities. This focus on user-centric design is evident in the platform's intuitive interface and robust security measures, which together create a seamless and secure user experience.

In summary, Juice Finance leverages the advanced capabilities of the Blast L2 network to offer a secure, efficient, and versatile DeFi platform. Its use of native rebasing tokens, gas refund mechanics, cross-margin lending, and customizable APIs sets it apart as a leading player in the decentralized finance space. The platform's innovative features and user-centric design make it a powerful tool for both individual users and businesses looking to maximize their financial potential within the Blast ecosystem.

Another significant application is the ability to access up to 3x leverage. This feature allows users to amplify their positions, potentially increasing their returns. However, it also comes with higher risk, making it suitable for more experienced traders. Additionally, Juice Finance integrates seamlessly with Blast’s unique rebasing tokens, allowing users to maximize their yield and point farming activities within the Blast ecosystem.

For businesses, Juice Finance provides Blockchain-as-a-Service (BaaS) solutions, which can help streamline operations and reduce costs. These solutions include expense management and cross-margin lending, enabling businesses to manage their finances more efficiently. The platform also facilitates cross-chain transactions, allowing for seamless transfers between different blockchain networks. This can be particularly useful for businesses that operate across multiple blockchain ecosystems.

Juice Finance also serves as a platform for borrowers and lenders. Borrowers can access DeFi protocols to obtain loans, while lenders can provide liquidity and earn interest on their assets. This creates a decentralized financial ecosystem where users can interact without the need for traditional banking intermediaries.

In the context of the Blast ecosystem, users can accumulate points and rewards, further incentivizing participation. These points can be used within the ecosystem, adding another layer of utility to the platform.

One of the earliest notable events for Juice Finance was the launch of their lending and borrowing protocol. This feature allowed users to leverage their assets, providing a robust foundation for the platform's financial operations. The introduction of the JUICE token was another pivotal moment, serving as the backbone of the ecosystem and enabling various functionalities within the platform.

The addition of point farming and airdrops further enhanced user engagement. Point farming allowed users to earn rewards by participating in the ecosystem, while airdrops distributed JUICE tokens to incentivize early adopters and active participants. These features not only increased user activity but also helped in building a loyal community around Juice Finance.

Juice Finance also garnered attention for its innovative cross-margin lending features. This functionality integrated seamlessly with Blast’s unique rebasing tokens, offering users a flexible and efficient way to manage their assets. The cross-margin lending feature was a significant advancement, providing users with the ability to maximize their leverage and optimize their investment strategies.

The platform's success in the DeFi space attracted funding from investors, further solidifying its position in the market. This influx of capital enabled Juice Finance to expand its offerings and continue innovating within the decentralized finance landscape. The funding also facilitated the development of new features and improvements to the existing protocol, ensuring that Juice Finance remained at the forefront of DeFi innovation.

In addition to these milestones, Juice Finance has consistently focused on enhancing user experience and security. The platform's technical documents and contracts synopsis provide detailed information on collateral and loans, ensuring transparency and trust within the community. This commitment to security and user satisfaction has been a key factor in Juice Finance's ongoing success.

Juice Finance's journey is marked by continuous innovation and strategic advancements. From the launch of their core lending and borrowing protocol to the introduction of the JUICE token and the implementation of point farming and airdrops, each event has played a crucial role in shaping the platform's trajectory. The integration with Blast’s rebasing tokens and the successful acquisition of investor funding further highlight Juice Finance's impact on the DeFi space.

What is Juice Finance?

Juice Finance (JUICE) stands as a pioneering force in the decentralized finance (DeFi) landscape, offering a permissionless lending protocol that empowers users with up to 3x leverage on their collateral. This leverage can be utilized in the most vetted and popular decentralized applications (DApps) within the Blast ecosystem, facilitating the accumulation of yield, points, airdrops, and rewards.Built on the Blast L2 network, Juice Finance is not just another DeFi protocol; it is a Cross-Margin DeFi protocol designed to provide users with up to 300% USDB leverage. This feature allows for enhanced yields across the ecosystem, making it a powerful tool for those looking to maximize their returns. The platform's core innovation lies in its cross-margin lending capabilities, seamlessly integrating with Blast’s rebasing tokens and ecosystem ethos.

Juice Finance's composable leverage feature is particularly noteworthy. It enables users to maximize their yield and point farming activities, thereby enhancing their overall DeFi experience. The protocol's design ensures that users can interact with various DApps within the Blast ecosystem without the need for multiple collateral deposits, streamlining the process and making it more efficient.

In addition to its technical prowess, Juice Finance is designed to be user-friendly, ensuring that both novice and experienced users can navigate the platform with ease. The protocol's permissionless nature means that anyone can participate, democratizing access to advanced financial tools and opportunities.

What is the technology behind Juice Finance?

Juice Finance operates on the cutting-edge Blast Layer 2 (L2) infrastructure, a technology designed to enhance scalability and reduce transaction costs on the blockchain. This permissionless lending and borrowing protocol allows users to access up to 3x leverage on their collateral, enabling them to engage with the most vetted and popular decentralized applications (DApps) within the Blast ecosystem. By leveraging the Blast L2 network, Juice Finance ensures that transactions are faster and more cost-effective compared to traditional Layer 1 blockchains.The Blast L2 network employs advanced security measures to prevent attacks from bad actors. One of the key features is its use of native rebasing tokens, which adjust their supply automatically to maintain a stable value. This mechanism helps in mitigating risks associated with price volatility, making the platform more secure and reliable for users. Additionally, the Blast L2 network incorporates gas refund mechanics, which incentivize users by refunding a portion of the transaction fees, thereby encouraging more participation and enhancing network security through increased activity.

Juice Finance's Cross-Margin DeFi protocol is another innovative aspect of its technology. This protocol allows users to leverage their assets up to 300% in USDB, providing significant opportunities for yield maximization and point farming within the Blast ecosystem. The cross-margin feature ensures that users can manage their collateral more efficiently, reducing the risk of liquidation and enabling more strategic financial maneuvers.

The integration of customizable APIs further enhances the platform's versatility, allowing businesses to tailor the Juice Finance services to their specific needs. These APIs facilitate seamless interactions with other financial services and applications, making it easier for businesses to incorporate Juice Finance into their existing systems. This level of customization and integration is crucial for businesses looking to optimize their financial operations and leverage the benefits of decentralized finance (DeFi).

Moreover, Juice Finance's composable leverage feature empowers users to maximize their yield farming activities. By allowing users to stack multiple layers of leverage, the platform enables more complex and potentially more profitable strategies. This composability is a significant advantage for experienced DeFi users who are looking to optimize their returns through sophisticated financial techniques.

The Blast ecosystem's ethos of innovation and security is deeply embedded in Juice Finance's technology. The platform's design prioritizes user empowerment, providing tools and features that enable users to take full control of their financial activities. This focus on user-centric design is evident in the platform's intuitive interface and robust security measures, which together create a seamless and secure user experience.

In summary, Juice Finance leverages the advanced capabilities of the Blast L2 network to offer a secure, efficient, and versatile DeFi platform. Its use of native rebasing tokens, gas refund mechanics, cross-margin lending, and customizable APIs sets it apart as a leading player in the decentralized finance space. The platform's innovative features and user-centric design make it a powerful tool for both individual users and businesses looking to maximize their financial potential within the Blast ecosystem.

What are the real-world applications of Juice Finance?

Juice Finance (JUICE) is a cutting-edge Cross-Margin DeFi protocol built on the Blast L2. It offers a range of real-world applications that cater to both individual users and businesses. One of the primary uses of Juice Finance is enabling users to earn passive yield. By staking their assets on the platform, users can generate returns without actively managing their investments. This is particularly beneficial for those looking to grow their cryptocurrency holdings over time.Another significant application is the ability to access up to 3x leverage. This feature allows users to amplify their positions, potentially increasing their returns. However, it also comes with higher risk, making it suitable for more experienced traders. Additionally, Juice Finance integrates seamlessly with Blast’s unique rebasing tokens, allowing users to maximize their yield and point farming activities within the Blast ecosystem.

For businesses, Juice Finance provides Blockchain-as-a-Service (BaaS) solutions, which can help streamline operations and reduce costs. These solutions include expense management and cross-margin lending, enabling businesses to manage their finances more efficiently. The platform also facilitates cross-chain transactions, allowing for seamless transfers between different blockchain networks. This can be particularly useful for businesses that operate across multiple blockchain ecosystems.

Juice Finance also serves as a platform for borrowers and lenders. Borrowers can access DeFi protocols to obtain loans, while lenders can provide liquidity and earn interest on their assets. This creates a decentralized financial ecosystem where users can interact without the need for traditional banking intermediaries.

In the context of the Blast ecosystem, users can accumulate points and rewards, further incentivizing participation. These points can be used within the ecosystem, adding another layer of utility to the platform.

What key events have there been for Juice Finance?

Juice Finance, a pioneering Cross-Margin DeFi protocol built on the Blast L2 network, has made significant strides in the decentralized finance space. The platform is designed to empower users with composable leverage, maximizing yield and point farming activities within the Blast ecosystem.One of the earliest notable events for Juice Finance was the launch of their lending and borrowing protocol. This feature allowed users to leverage their assets, providing a robust foundation for the platform's financial operations. The introduction of the JUICE token was another pivotal moment, serving as the backbone of the ecosystem and enabling various functionalities within the platform.

The addition of point farming and airdrops further enhanced user engagement. Point farming allowed users to earn rewards by participating in the ecosystem, while airdrops distributed JUICE tokens to incentivize early adopters and active participants. These features not only increased user activity but also helped in building a loyal community around Juice Finance.

Juice Finance also garnered attention for its innovative cross-margin lending features. This functionality integrated seamlessly with Blast’s unique rebasing tokens, offering users a flexible and efficient way to manage their assets. The cross-margin lending feature was a significant advancement, providing users with the ability to maximize their leverage and optimize their investment strategies.

The platform's success in the DeFi space attracted funding from investors, further solidifying its position in the market. This influx of capital enabled Juice Finance to expand its offerings and continue innovating within the decentralized finance landscape. The funding also facilitated the development of new features and improvements to the existing protocol, ensuring that Juice Finance remained at the forefront of DeFi innovation.

In addition to these milestones, Juice Finance has consistently focused on enhancing user experience and security. The platform's technical documents and contracts synopsis provide detailed information on collateral and loans, ensuring transparency and trust within the community. This commitment to security and user satisfaction has been a key factor in Juice Finance's ongoing success.

Juice Finance's journey is marked by continuous innovation and strategic advancements. From the launch of their core lending and borrowing protocol to the introduction of the JUICE token and the implementation of point farming and airdrops, each event has played a crucial role in shaping the platform's trajectory. The integration with Blast’s rebasing tokens and the successful acquisition of investor funding further highlight Juice Finance's impact on the DeFi space.

Who are the founders of Juice Finance?

Juice Finance (JUICE), a leading disruptive Cross-Margin DeFi protocol built on the Blast L2, was founded by Moshe Golomb, Mark Petersen, and Juan Fernandez. Moshe Golomb, with a background in blockchain technology and financial systems, played a pivotal role in integrating cross-margin lending features. Mark Petersen, known for his expertise in decentralized finance, contributed significantly to the platform's composable leverage capabilities. Juan Fernandez, a specialist in rebasing tokens, ensured seamless integration with Blast’s unique ecosystem ethos. Together, they have designed Juice Finance to empower users with advanced yield and point farming activities within the Blast ecosystem.| Website | www.juice.finance/ |

| Website | juice-finance.gitbook.io/juice-finance |

| Socials | twitter.com/juice_finance |

| Socials | t.co/J44sbp6ROk |

| Contracts | 0x818a...5c0923 |

| Explorers | blastexplorer.io/address/0x818a92bc81Aad0053d72ba753fb5Bc3d0C5C0923 |