The ICHI token is the governance and value token of ICHI Protocols.

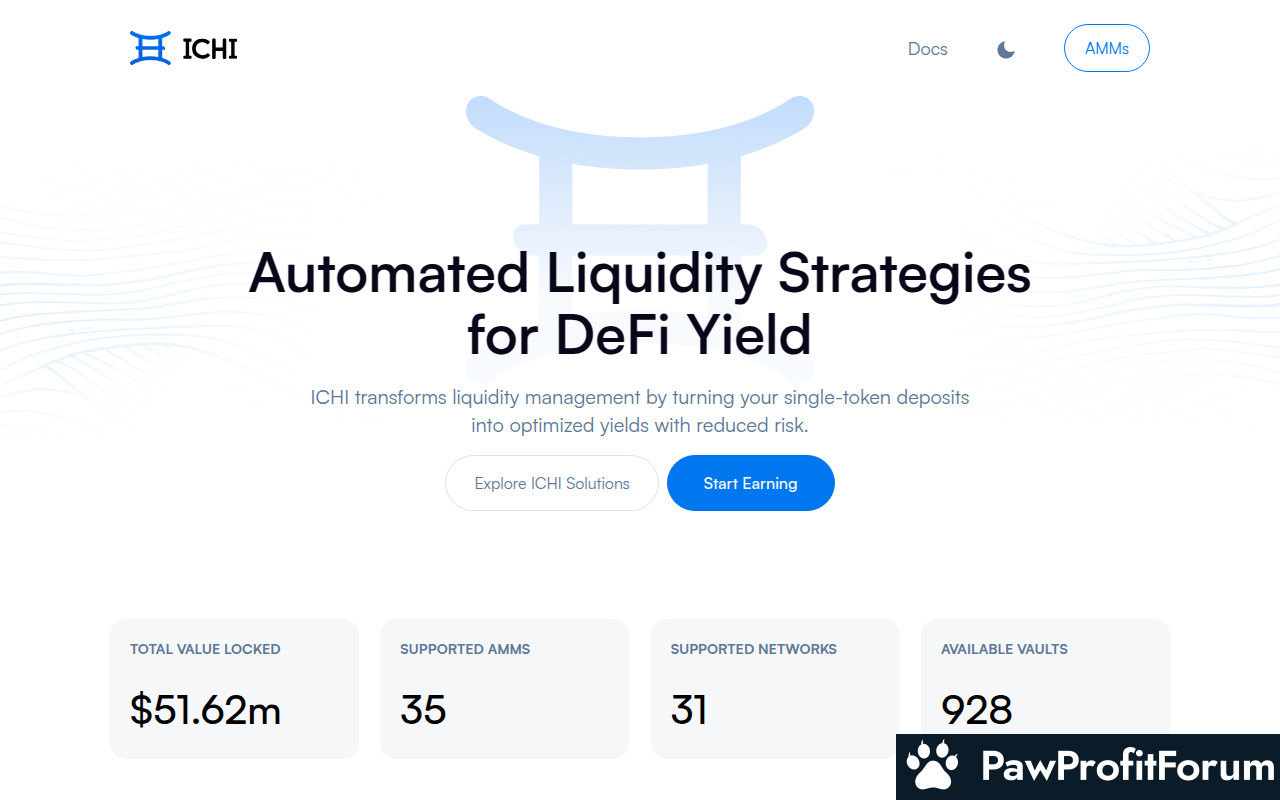

ICHI has built 2 protocols to date, including Vaults (single-token Uniswap v3 liquidity managers earning high yields) and Branded Dollars (Community-owned over-collateralized stable assets).

Vaults, one of ICHI's key protocols, act as single-token Uniswap v3 liquidity managers, enabling users to earn high yields. This protocol simplifies liquidity provision by managing the complexities of Uniswap v3, allowing users to maximize their returns without needing deep technical knowledge. On the other hand, Branded Dollars are community-owned, over-collateralized stable assets, providing a stable and reliable form of currency within the ecosystem.

ICHI also plays a crucial role in governance. It empowers the ichi.org community to make decisions regarding the platform's future and enables other communities to govern their own stablecoins. This decentralized approach ensures that the platform evolves in a way that aligns with the interests of its users.

Partnerships with various organizations and companies in the blockchain industry further bolster ICHI's ecosystem. These collaborations enhance the platform's capabilities and expand its reach, making it a significant player in the decentralized finance (DeFi) space.

One of the standout features of ICHI's technology is "Profitable Liquidity Provision," which includes a component called "Yield IQ." Yield IQ functions as an auto-liquidity manager, optimizing the allocation of liquidity to maximize returns. This automated rebalancing and dynamic liquidity management are crucial for maintaining the efficiency and profitability of liquidity pools. By continuously adjusting the liquidity based on market conditions, Yield IQ helps to ensure that liquidity providers earn the highest possible yields.

ICHI has also developed two key protocols: Vaults and Branded Dollars. Vaults are single-token Uniswap v3 liquidity managers designed to earn high yields. These Vaults simplify the process of providing liquidity by automating the management of liquidity positions, making it easier for users to participate in liquidity provision without needing to constantly monitor and adjust their positions. This automation is particularly beneficial in the volatile world of cryptocurrency, where market conditions can change rapidly.

Branded Dollars, on the other hand, are community-owned, over-collateralized stable assets. These stablecoins are designed to maintain their value by being backed by a surplus of collateral, which helps to ensure their stability even in times of market turbulence. The concept of Branded Dollars allows communities to create their own stable assets, tailored to their specific needs and backed by their chosen collateral.

Security is a paramount concern in the blockchain space, and ICHI addresses this through several mechanisms. The Ethereum blockchain itself is secured by a vast network of nodes that validate transactions and maintain the integrity of the ledger. This decentralized structure makes it extremely difficult for bad actors to manipulate the system. Additionally, ICHI employs smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts are audited and tested to ensure they function as intended, further enhancing the security of the platform.

ICHI's partnerships with companies and organizations such as Efficient Frontier, Loopring, and Microsoft highlight its commitment to integrating cutting-edge technology and expertise. These collaborations bring additional layers of innovation and reliability to the ICHI ecosystem, ensuring that it remains at the forefront of blockchain technology and financial solutions.

The ICHI token itself serves as the governance and value token of the ICHI Protocols. This means that holders of ICHI tokens have a say in the decision-making processes of the platform, allowing the community to participate in shaping the future of the protocol. Governance tokens like ICHI are essential for decentralized platforms, as they ensure that the community has a voice and that the platform evolves in a way that benefits its users.

In the realm of blockchain technology, preventing attacks from bad actors is a continuous challenge. ICHI leverages the inherent security features of the Ethereum blockchain, such as its consensus mechanism and cryptographic techniques, to safeguard against potential threats. The decentralized nature of the blockchain means that there is no single point of failure, making it resilient against attacks. Furthermore, the use of smart contracts ensures that transactions are executed exactly as programmed, without the need for intermediaries, reducing the risk of fraud or manipulation.

ICHI's technology is a comprehensive blend of advanced blockchain features, automated financial mechanisms, and robust security measures. By integrating these elements, ICHI provides a secure, efficient, and profitable platform for liquidity provision and stable asset creation, catering to the diverse needs of its community and partners.

Another significant application of ICHI is in the realm of liquidity management. Through its Vaults protocol, ICHI enables single-token Uniswap v3 liquidity managers to earn high yields. This is particularly beneficial for users looking to provide liquidity with minimal risk, as it allows them to earn returns while maintaining control over their assets.

ICHI also plays a crucial role in fostering sustainable on-chain returns and deep liquidity. By partnering with various organizations, ICHI helps create a robust and interconnected financial ecosystem. These partnerships extend to a wide range of sectors, enhancing the utility and reach of the ICHI token.

The decentralized nature of ICHI is further emphasized through its community-driven approach. Active participation on social media platforms like Twitter and Discord ensures that the community remains engaged and informed. This decentralized governance model allows for more democratic decision-making processes, giving token holders a voice in the future development of the protocols.

Additionally, ICHI's ability to facilitate low-slippage growth for any token is a notable feature. This means that transactions involving ICHI can be executed with minimal price impact, making it an attractive option for traders and investors looking to minimize costs.

ICHI's real-world applications extend beyond just financial transactions. Its role in governance, liquidity management, and community engagement makes it a versatile and valuable asset in the cryptocurrency space.

One of the significant milestones for ICHI was the launch of their app, which provided users with a streamlined interface to interact with the ICHI ecosystem. This development was crucial in enhancing user engagement and accessibility.

In a strategic move to expand its ecosystem, ICHI formed partnerships with various organizations. These collaborations aimed to integrate ICHI's protocols with other platforms, thereby broadening its reach and utility within the decentralized finance (DeFi) landscape.

The release of the Yield IQ feature marked another key event for ICHI. Yield IQ is designed to optimize yield farming strategies, allowing users to maximize their returns on investments within the ICHI ecosystem. This feature has been instrumental in attracting more users to the platform, seeking higher yields on their crypto assets.

In an effort to engage the community and promote wider adoption, ICHI hosted a giveaway. This event not only rewarded loyal users but also attracted new participants to the ICHI ecosystem, fostering a sense of community and shared growth.

The launch on Binance Smart Chain was a significant step for ICHI, enabling faster and more cost-effective transactions. This integration allowed ICHI to tap into the vast user base of Binance Smart Chain, further enhancing its liquidity and adoption.

On April 10, 2022, ICHI faced a major challenge when the value of its governance token collapsed due to cascading liquidations in the Rari Fuse Pool. This event highlighted the vulnerabilities within DeFi protocols and underscored the importance of robust risk management strategies.

ICHI Vaults, which manage single-token liquidity in decentralized finance, have been a cornerstone of ICHI's offerings. These vaults enable users to earn high yields on their assets, making them an attractive option for liquidity providers.

The potential for ICHI to reach a maximum price level of $12.92 by the end of 2031 has been a topic of discussion among analysts, reflecting the long-term growth prospects of the token. This projection underscores the confidence in ICHI's protocols and their ability to deliver value to users over time.

ICHI's journey has been marked by innovation, strategic partnerships, and community engagement, positioning it as a notable player in the DeFi space.

ICHI has built 2 protocols to date, including Vaults (single-token Uniswap v3 liquidity managers earning high yields) and Branded Dollars (Community-owned over-collateralized stable assets).

What is ICHI?

ICHI stands out as a multifaceted cryptocurrency, serving as both a governance and value token within the ICHI Protocols. At its core, ICHI facilitates community-driven liquidity provision and income maximization for depositors. This is achieved through its innovative Vaults and Branded Dollars protocols.Vaults, one of ICHI's key protocols, act as single-token Uniswap v3 liquidity managers, enabling users to earn high yields. This protocol simplifies liquidity provision by managing the complexities of Uniswap v3, allowing users to maximize their returns without needing deep technical knowledge. On the other hand, Branded Dollars are community-owned, over-collateralized stable assets, providing a stable and reliable form of currency within the ecosystem.

ICHI also plays a crucial role in governance. It empowers the ichi.org community to make decisions regarding the platform's future and enables other communities to govern their own stablecoins. This decentralized approach ensures that the platform evolves in a way that aligns with the interests of its users.

Partnerships with various organizations and companies in the blockchain industry further bolster ICHI's ecosystem. These collaborations enhance the platform's capabilities and expand its reach, making it a significant player in the decentralized finance (DeFi) space.

What is the technology behind ICHI?

The technology behind ICHI, represented by the ticker ICHI, is a fascinating blend of innovative blockchain solutions and advanced financial mechanisms. At its core, ICHI operates on the Ethereum blockchain, leveraging the robust security and decentralized nature of this well-established network. Ethereum's blockchain ensures that transactions are transparent, immutable, and secure, making it a reliable foundation for ICHI's operations.One of the standout features of ICHI's technology is "Profitable Liquidity Provision," which includes a component called "Yield IQ." Yield IQ functions as an auto-liquidity manager, optimizing the allocation of liquidity to maximize returns. This automated rebalancing and dynamic liquidity management are crucial for maintaining the efficiency and profitability of liquidity pools. By continuously adjusting the liquidity based on market conditions, Yield IQ helps to ensure that liquidity providers earn the highest possible yields.

ICHI has also developed two key protocols: Vaults and Branded Dollars. Vaults are single-token Uniswap v3 liquidity managers designed to earn high yields. These Vaults simplify the process of providing liquidity by automating the management of liquidity positions, making it easier for users to participate in liquidity provision without needing to constantly monitor and adjust their positions. This automation is particularly beneficial in the volatile world of cryptocurrency, where market conditions can change rapidly.

Branded Dollars, on the other hand, are community-owned, over-collateralized stable assets. These stablecoins are designed to maintain their value by being backed by a surplus of collateral, which helps to ensure their stability even in times of market turbulence. The concept of Branded Dollars allows communities to create their own stable assets, tailored to their specific needs and backed by their chosen collateral.

Security is a paramount concern in the blockchain space, and ICHI addresses this through several mechanisms. The Ethereum blockchain itself is secured by a vast network of nodes that validate transactions and maintain the integrity of the ledger. This decentralized structure makes it extremely difficult for bad actors to manipulate the system. Additionally, ICHI employs smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts are audited and tested to ensure they function as intended, further enhancing the security of the platform.

ICHI's partnerships with companies and organizations such as Efficient Frontier, Loopring, and Microsoft highlight its commitment to integrating cutting-edge technology and expertise. These collaborations bring additional layers of innovation and reliability to the ICHI ecosystem, ensuring that it remains at the forefront of blockchain technology and financial solutions.

The ICHI token itself serves as the governance and value token of the ICHI Protocols. This means that holders of ICHI tokens have a say in the decision-making processes of the platform, allowing the community to participate in shaping the future of the protocol. Governance tokens like ICHI are essential for decentralized platforms, as they ensure that the community has a voice and that the platform evolves in a way that benefits its users.

In the realm of blockchain technology, preventing attacks from bad actors is a continuous challenge. ICHI leverages the inherent security features of the Ethereum blockchain, such as its consensus mechanism and cryptographic techniques, to safeguard against potential threats. The decentralized nature of the blockchain means that there is no single point of failure, making it resilient against attacks. Furthermore, the use of smart contracts ensures that transactions are executed exactly as programmed, without the need for intermediaries, reducing the risk of fraud or manipulation.

ICHI's technology is a comprehensive blend of advanced blockchain features, automated financial mechanisms, and robust security measures. By integrating these elements, ICHI provides a secure, efficient, and profitable platform for liquidity provision and stable asset creation, catering to the diverse needs of its community and partners.

What are the real-world applications of ICHI?

ICHI (ICHI) serves as the governance and value token for the ICHI Protocols, which are designed to manage capital and provide on-chain liquidity. One of its primary applications is in the creation and management of branded stablecoins, known as Branded Dollars. These are community-owned, over-collateralized stable assets that help various organizations maintain their own stablecoins, ensuring financial stability and liquidity within their ecosystems.Another significant application of ICHI is in the realm of liquidity management. Through its Vaults protocol, ICHI enables single-token Uniswap v3 liquidity managers to earn high yields. This is particularly beneficial for users looking to provide liquidity with minimal risk, as it allows them to earn returns while maintaining control over their assets.

ICHI also plays a crucial role in fostering sustainable on-chain returns and deep liquidity. By partnering with various organizations, ICHI helps create a robust and interconnected financial ecosystem. These partnerships extend to a wide range of sectors, enhancing the utility and reach of the ICHI token.

The decentralized nature of ICHI is further emphasized through its community-driven approach. Active participation on social media platforms like Twitter and Discord ensures that the community remains engaged and informed. This decentralized governance model allows for more democratic decision-making processes, giving token holders a voice in the future development of the protocols.

Additionally, ICHI's ability to facilitate low-slippage growth for any token is a notable feature. This means that transactions involving ICHI can be executed with minimal price impact, making it an attractive option for traders and investors looking to minimize costs.

ICHI's real-world applications extend beyond just financial transactions. Its role in governance, liquidity management, and community engagement makes it a versatile and valuable asset in the cryptocurrency space.

What key events have there been for ICHI?

ICHI, the governance and value token of ICHI Protocols, has been at the forefront of several pivotal developments in the cryptocurrency space. The token is integral to two primary protocols: Vaults, which manage single-token Uniswap v3 liquidity, and Branded Dollars, community-owned over-collateralized stable assets.One of the significant milestones for ICHI was the launch of their app, which provided users with a streamlined interface to interact with the ICHI ecosystem. This development was crucial in enhancing user engagement and accessibility.

In a strategic move to expand its ecosystem, ICHI formed partnerships with various organizations. These collaborations aimed to integrate ICHI's protocols with other platforms, thereby broadening its reach and utility within the decentralized finance (DeFi) landscape.

The release of the Yield IQ feature marked another key event for ICHI. Yield IQ is designed to optimize yield farming strategies, allowing users to maximize their returns on investments within the ICHI ecosystem. This feature has been instrumental in attracting more users to the platform, seeking higher yields on their crypto assets.

In an effort to engage the community and promote wider adoption, ICHI hosted a giveaway. This event not only rewarded loyal users but also attracted new participants to the ICHI ecosystem, fostering a sense of community and shared growth.

The launch on Binance Smart Chain was a significant step for ICHI, enabling faster and more cost-effective transactions. This integration allowed ICHI to tap into the vast user base of Binance Smart Chain, further enhancing its liquidity and adoption.

On April 10, 2022, ICHI faced a major challenge when the value of its governance token collapsed due to cascading liquidations in the Rari Fuse Pool. This event highlighted the vulnerabilities within DeFi protocols and underscored the importance of robust risk management strategies.

ICHI Vaults, which manage single-token liquidity in decentralized finance, have been a cornerstone of ICHI's offerings. These vaults enable users to earn high yields on their assets, making them an attractive option for liquidity providers.

The potential for ICHI to reach a maximum price level of $12.92 by the end of 2031 has been a topic of discussion among analysts, reflecting the long-term growth prospects of the token. This projection underscores the confidence in ICHI's protocols and their ability to deliver value to users over time.

ICHI's journey has been marked by innovation, strategic partnerships, and community engagement, positioning it as a notable player in the DeFi space.

Who are the founders of ICHI?

ICHI, represented by the ticker ICHI, serves as the governance and value token of the ICHI Protocols. The founder of ICHI is Don Thibeau. Thibeau has played a pivotal role in the creation and development of ICHI, leveraging his expertise to build innovative solutions within the cryptocurrency space. Under his leadership, ICHI has introduced two key protocols: Vaults, which are single-token Uniswap v3 liquidity managers designed to earn high yields, and Branded Dollars, which are community-owned, over-collateralized stable assets.| Website | www.ichi.org/ |

| Socials | twitter.com/ichifoundation |

| Socials | t.me/ichifarm |

| Contracts | 0x1111...6bc4d6 |

| Audits | https://cmc.certik-skynet.com/redirect?project=ichi |

| Explorers | etherscan.io/token/0x111111517e4929d3dcbdfa7cce55d30d4b6bc4d6 |

| Wallets | metamask.io/ |